Third quarter of 2022

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Piling on the misery

In the face of rising inflation, exacerbated by the war in Ukraine, central bankers have condemned for their relative inaction. However, in the third quarter of 2022, they stepped up a gear. Last month’s economic and political roundup highlighted a comment from Jerome Powell (chair of the Federal Reserve), who said “We have got to get inflation behind us. I wish there were a painless way to do that, there isn’t”. That hit sentiment across the globe. In the UK, the new government compounded the problem with a series of policy missteps and U-turns that served to further unnerve investors and will likely prolong and deepen the looming recession.

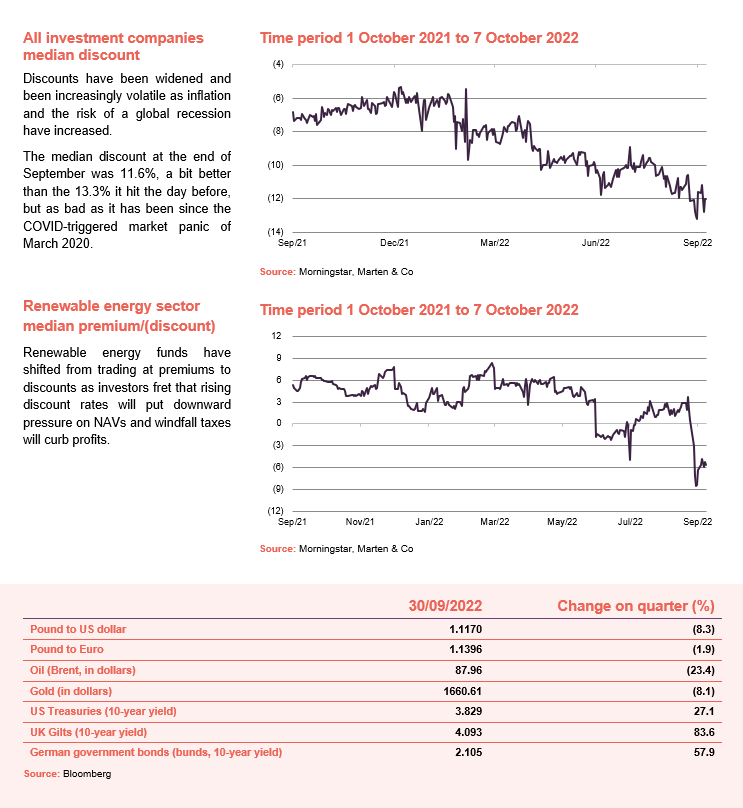

In this environment, discounts have widened across the sector, fundraising has stalled, funds with excessive gearing (especially those with floating rate debt) look vulnerable, and previous safe havens have lost that status.

On the bright side, that creates opportunities for those with the liquidity to take advantage of them. This is also when the benefits of closed-end structures shine through. As we saw a couple of years ago with COVID, the ability to dip into revenue reserves can help preserve the flow of income to investors.

New research

Over the quarter, we published notes on: Urban Logistics REIT, JLEN Environmental Assets, Baillie Gifford UK Growth, Chrysalis Investments, abrdn Private Equity Opportunities, Temple Bar, JPMorgan Multi-Asset Growth and Income, Gulf Investment, North American Income Trust, GCP Infrastructure, JPMorgan Japanese, Grit Real Estate Income, and Montanaro UK Smaller Companies. You can read all of these notes by clicking on the links above or by visiting our website.

At a glance

Winners and losers

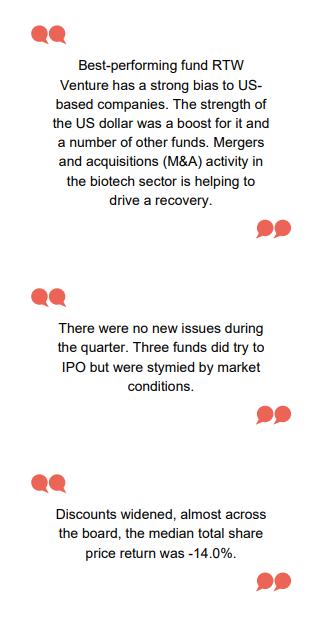

Out of a total of 348 investment companies that we follow, the median total NAV return over the second quarter of 2022 was -4.7%. As discounts widened, almost across the board, the median total share price return was -14.0%.

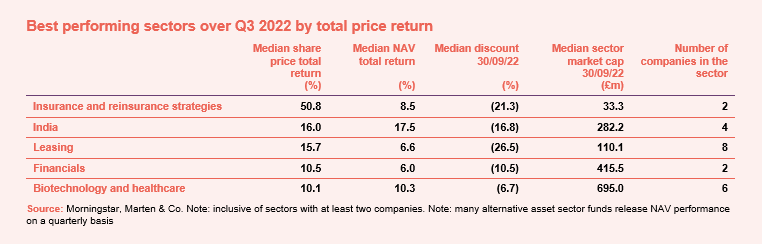

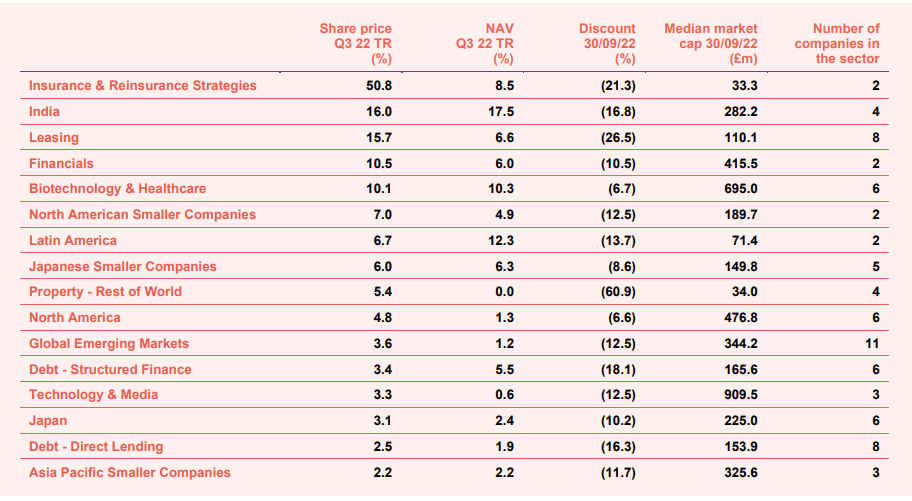

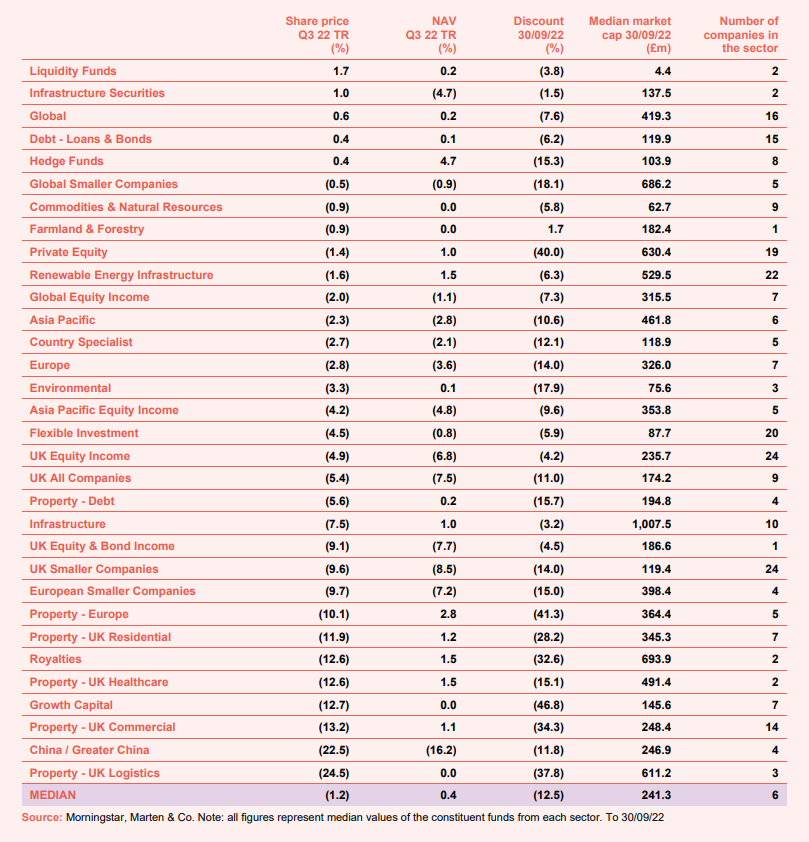

By sector

Once again, the best performing sector over the quarter was insurance & reinsurance strategies as one of its two members, CatCo Reinsurance, continues to make progress with its wind up and the other, Life Settlement Assets, reported strong NAV growth. The Indian economy/stock market appears to have decoupled from other emerging markets. The leasing sector has been buoyed by the ship leasing funds and a modest recovery in some of the share prices of the aircraft easing funds. In the financials sector, the announcement of a return of capital by Trian Investors 1 narrowed its discount. Investors seem to have decided that the biotechnology and healthcare sector was oversold, perhaps persuaded by an uptick in takeover activity.

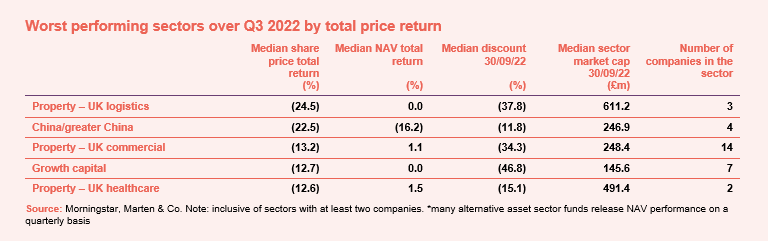

A quick glance at the above table is enough to see that property-related sectors were hit hard in Q3. The problem is rising interest rates, which are expected to drive up property yields/drive down values. That has not yet been reflected in NAVs, as is clear in the table. The logistics sector has been an investor favourite and QuotedData’s analyst believes that the demand/supply dynamic still works in favour of rising rents (as you can read in our latest note on Urban Logistics REIT).

Otherwise, Chinese funds suffered once again on anaemic economic growth and the growth capital sector was hit by problems with a number of underlying investments on top of the general aversion to growth stocks.

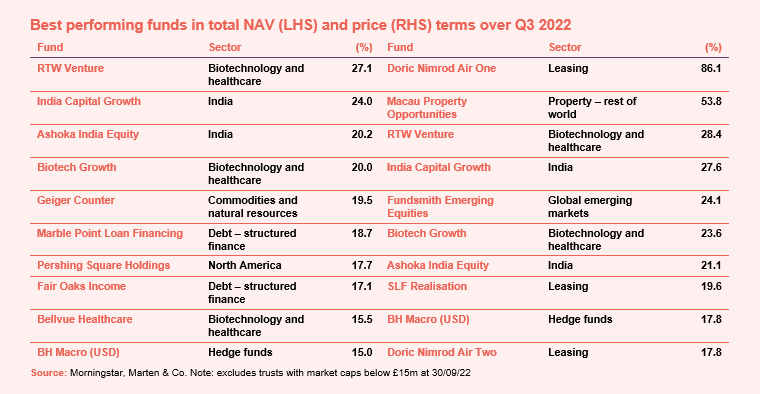

Top 10 performers by fund

Given the general antipathy towards growth stocks, it was interesting to see a rebound in the NAVs and share prices of a number of funds in the biotechnology and healthcare sector over the quarter. RTW Venture, which tops the list, has a strong bias to US-based companies. The strength of the US dollar (see page 3) was a boost for it and a number of other funds. It reported that mergers and acquisitions (M&A) activity in the sector was the highest that it had been since the second quarter of 2018. This has helped rekindle interest in the sector, benefiting Biotech Growth and Bellvue Healthcare as well.

The two Indian funds with the greatest exposure to small and mid cap stocks – India Capital Growth and Ashoka India Equity – also did well. India’s domestic economy appears to be thriving, shrugging off the gloom that has enveloped most other large markets. Conversations with the manager of India Capital Growth suggest that the reforms enacted by the government in recent years are now bearing fruit.

Geiger Counter has had a volatile few months, but the global energy crisis has helped to stimulate renewed appetite for nuclear power, which is working to its advantage. Marble Point Loan Financing is a beneficiary of the stronger dollar. The big plus point for it and similar funds such as Fair Oaks Income is that they are invested in floating rate loans and so are seeing increased income flow through as interest rates rise. Some caution may be required, however, as the risk of loan defaults is probably rising too.

Doric Nimrod Air One surprised the market by reaching an agreement with Emirates to sell its sole A380 to the airline at the end of its lease. Macau Property Opportunities made some disposals too.

Fundsmith Emerging Equities rose in price as its manager threw in the towel. The board is opting to liquidate the fund rather than seek a new manager. BH Macro is seeing more opportunities to make money in volatile markets.

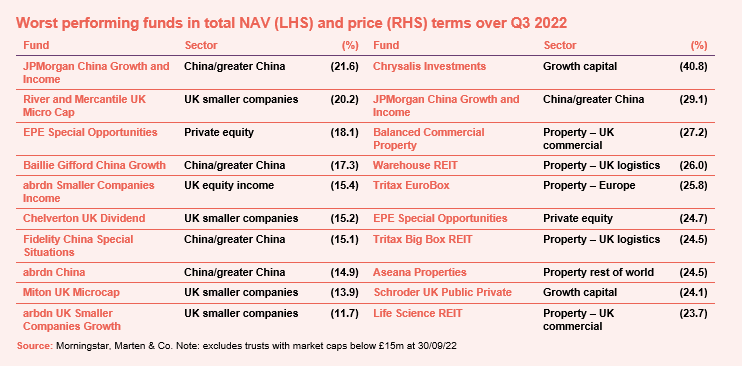

Bottom 10 performers by fund

China’s rigid adherence to a zero-COVID policy is hitting its economic output. Sentiment was already against the country as an increasingly authoritarian government makes bellicose statements about its neighbours. An ongoing problem with bad debt in the property sector is also weighing on returns. All four funds in the China/greater China sector feature in the list.

The other country that has fallen further out of favour over the quarter is the UK. International investors have been wary of our economy since Brexit, but the new government’s disastrous ‘mini’ budget has put pressure on sterling, bond yields and growth forecasts. Funds focused on UK smaller companies are generally reckoned to be more exposed to the health of the UK economy and have been hit hardest. Both microcap funds and a number of smaller companies funds, including EPE Special Opportunities which also backs small, albeit mostly unlisted companies, feature on the list of fallers. The falls in EPE and Chelverton UK Dividend’s NAVs are amplified by their zero dividend preference shares.

In share price terms, Chrysalis’ write down of its holding in Klarna further knocked confidence in the stock (we published a note on the fund which explores what is happening within its portfolio). Fellow growth capital stock Schroder UK Public Private had its problems too, writing off Rutherford Health, which used to be its largest investment, in the quarter.

The other theme dominating the share price falls was the hit to property funds from expectations of rising valuation yields (pushing down NAVs). Previously favoured areas such as logistics (which includes Tritax EuroBox) were hit hardest. Investors’ expectation is that the NAVs will probably catch up with the share prices in time.

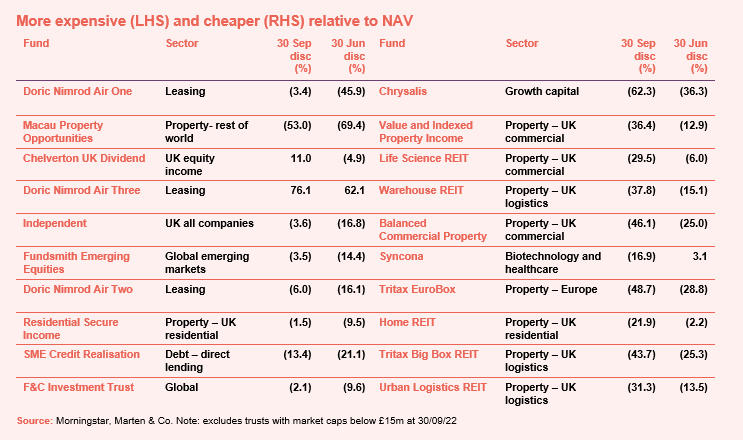

Significant rating changes by fund

Getting more expensive

Doric Nimrod Air One’s success in selling its main asset encouraged a re-rating of other Doric Nimrod funds. Macau Property’s property sales resulted in a narrowing of its discount, but there is still a long way to go. Chelverton UK Dividend’s premium looks odd given its poor NAV returns. The premium has moderated a bit since the end of the quarter. Independent announced that it would merge with Monks Investment Trust and this helped narrow its discount. Fundsmith Emerging Equities plan to liquidate. Residential Secure Income bucked the trend of discount widening within the property sectors during the quarter but has succumbed since. SME Credit Realisation is getting closer to the end of its life. The pleasing thing (to us anyway) is to see F&C Investment Trust on this list. It and Alliance Trust have done a good job of keeping their discounts in check through the recent turmoil.

Getting cheaper

The discount on Chrysalis continues to widen. The managers have ceased making new investments and are instead focused on preserving value within the existing portfolio. Not everything will survive, but the managers would argue that the market is being too pessimistic about the prospects of the portfolio as a whole.

Property-focused funds dominate the list of widening discounts for reasons already discussed. QuotedData’s Richard Williams had the opportunity to interview Life Science REIT’s Simon Farnsworth recently. You can listen back to the interview here.

Syncona bucked the trend of better performance for the biotechnology and healthcare sector. This may reflect its bias to unlisted investments, which have not been re-rated, as well as its membership of the FTSE250 Index, which has been a target for short-sellers.

Money raised and returned

Money coming in

There were no new issues during the quarter. Three funds did try to IPO but were stymied by market conditions:

- Sustainable Farmland Trust was targeting £200m, it “decided to pause its initial public offering due to the current high levels of market volatility and uncertainty” on 10 October 2022;

- Welkin China Private Equity extended the closing date for its IPO to end October; and

- Independent Living REIT, which was targeting £150m, decided not to proceed with its IP on 30 September 2022.

HICL Infrastructure raised £160m to pay down its revolving credit facility (RCF). Likewise, SDCL Energy Efficiency raised £135m to pay down its RCF and provide capital to fund pipeline opportunities. VH Global Sustainable Energy Opportunities was hoping to raise £150m to help fund opportunities including Mexican onshore wind, hydropower in Brazil, and flexible carbon capture and storage in the UK.

Pantheon Infrastructure raised £80.8m as its subscription shares (issued in connection with its IPO) were all exercised. However, a subsequent attempt to raise an additional £250m has been abandoned.

Digital9 Infrastructure raised £60m in July, but it was probably hoping for more. The money went towards paying for its purchase of Arquiva. It is a shame that the retail investor part of the offer had to be scaled back as we are still playing by EU prospectus rules.

Otherwise, flexible investment funds, which seek to protect investors from the worst of market falls, were understandably in demand. City of London, which has an enviable track record of increasing its dividend each year for many decades, was also issuing shares.

In addition (not shown in table), LXI REIT expanded as it absorbed Secure Income REIT and JPMorgan Global Growth and Income grew as it absorbed Scottish Investment Trust.

Money going out

The money going out column reflect share buybacks from a group of relatively large trusts. In addition, ScotGems was placed into liquidation on 8 September 2022.

Major news stories over Q3 2022

Portfolio developments

- HICL to acquire Texas Nevada transmission and Hornsea II windfarm

- Oakley Capital backs vLex

- Renewables Infrastructure battery storage investment

- Abrdn UK Smaller Companies – Nimmo bows out

- NextEnergy enters new jv with Eelpower

- JLEN Environmental Assets investment in commercial glasshouse-controlled environment space

- Another good year for City of London

- Very disappointing year for JPMorgan Mid Cap

- Murray Income misses out on value rally

- JLEN Environmental Assets/Foresight Solar battery project

- Bluefield Solar posts strongest results since IPO

- Pantheon will battle discount with buybacks

- HydrogenOne backs Strohm pipeline business

- Taylor Maritime announces all cash offer for Grindrod Shipping

- Hipgnosis Songs to receive withheld streaming revenues – US Copyright Royalty Board decision

- JPMorgan Global Core Real Assets boosted by private and liquid strategies

- Schroder British Opportunities held back by listed holdings

- BB Biotech shares rise as sector sees signs of recovery

- Henderson Diversified Income hit by ‘fundamental change in perception of inflation’

Corporate news

- SDCL Energy Efficiency Income looking to raise £100m

- Finally, a solution to the Trian Investors 1 conundrum

- Welkin China Private Equity targets $300m IPO

- The Sustainable Farmland Trust targets £200m IPO

- New supported living REIT plans IPO

- Pantheon Infrastructure targets £250m in issue of new C shares

- Fundsmith Emerging Equities to enter voluntary liquidation

- Harmony Energy Income hoping to issue C shares

- Independent and Monks combine forces

- Time’s up for Axiom European Financial Debt

- Aberdeen New India to introduce conditional tender offer following underperformance

- Octopus Renewables Infrastructure seeks shareholder approval to invest more in offshore wind farms

- Digital 9 Infrastructure fundraise pulls in £60m

- HICL Infrastructure announces fundraise

- Seraphim Space updates on plans for remaining cash

- JPMorgan Russian hopes to shift focus to Emerging Europe, the Middle East and Africa

Property news

- LXI REIT sells ‘income strip’ on Thorp Park and Alton Towers

- Helical sells TikTok office for £158.5m

- Home REIT continues portfolio expansion

- Civitas Social Housing updates on new lease clause

- LXI REIT considers equity raise to fund £500m Sainsbury’s portfolio buy

- Landsec sells Moorgate station office for £809m

- Ceiba struggles to access cash in Cuba

- Supermarket Income REIT goes on £76m shopping spree

- Palace Capital to become focused on ESG

- Impact Healthcare REIT raises £22.3m in placing

- Town Centre Securities sells stake in parking app at huge uplift

Managers and fees

- Sam Vecht becomes lead manager of BlackRock Latin American

- Tritax Eurobox appoints new fund manager

- JPMorgan American’s Parton announces retirement, while trust reports tough start to 2022

- Templeton Emerging Markets reduces management fee

- abrdn New Dawn cuts fees

- Ruffer’s Hamish Baillie to step down after 20 years

QuotedData views

- GP struggles may significant – 1 July

- Multi-manager trusts – a safe haven in current choppy markets? – 8 July

- (Half) year in review – 15 July

- Is the tide finally turning for biotech? – 22 July

- More power to battery growth story – 29 July

- The logistics paradox – 5 August

- Meaningful mergers – 12 August

- Small is beautiful – 19 August

- Here comes the rain again – 9 September

- If you can’t beat ‘em, join ‘em? – 16 September

- Supermarket sweep – 23 September

- Managers question UK small cap weakness – 30 September

Visit www.quoteddata.com or more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled.

Interviews

Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest discussing a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 1 July | AIE, CHRY | Andrew Beal | Schroder BSC Social Impact |

| 8 July | DGI9, HICL, SONG, IHR, ORIT, RHM | David Conlon & Joanne Fisk | GCP Asset-Backed Income |

| 22 July | HDIV, PCT | Philip Kent | GCP Infrastructure |

| 29 July | RNEW, JRS, SSIT | Stuart Widdowson | Odyssean Investment Trust |

| 5 August | FEET, JLEN | Kamal Warraich | Canaccord Genuity Wealth Mgmt |

| 12 August | BPCR, IIT, MKNS, TI1 | David Smith | Henderson High Income |

| 19 August | AXI BSIF | Fiona Yang | Invesco Asia |

| 26 August | DGI9, RWK, SHED | Nick Brind | Polar Capital Global Financials |

| 2 September | SDCL, TI1 | Tim Levine | Augmentum Fintech |

| 9 September | UK renewables | Joe Bauernfreund | AVI Japan Opportunity |

| 16 September | FEET | Stuart Gray | Alliance Trust |

| 23 September | CTY, MUT, SUPR, LXI | Matthias Siller | Baring Emerging EMEA Opportunities |

| 30 September | BSIF, discount rates | Masaki Taketsume | Schroder Japan Growth |

Research notes published over Q3 2022

Recently, Urban Logistics REIT’s (SHED’s) share price has fallen to a wide discount rating to its net asset value (NAV), as the rising cost of debt and concerns over a protracted recession have hit sentiment towards the logistics property sector. However, the long-term trends that have characterised growth in the sector remain and are even more acute in the ‘last mile’ sub-sector that SHED operates. Supply of logistics space is at record lows, while tenant demand is robust, with lettings for the first half of the year at record highs.

In recent weeks, JLEN Environmental Assets Group (JLEN) has further diversified its portfolio with three new investments, a battery storage project and two investments in the low carbon and sustainable solutions portion of its portfolio; a controlled environment aquaculture facility in Norway; and a UK glasshouse construction project drawing low-carbon heat and power from an existing anaerobic digestion plant owned by JLEN.

In an environment of volatile energy prices and uncertainty over the shape of future electricity market reforms, investors may be reassured by the breadth of JLEN’s portfolio and the managers’ ability to find new ways of adding value.

12 months as inflation expectations have risen, bringing with them interest rate rises and, in all likelihood, a recession. The selling-off of many ‘growth’ stocks has been severe and, BGUK’s managers say, indiscriminate, with good companies being hit as well as the bad. However, this provides an opportunity for long-term investors. The managers have been reappraising their investment cases in light of the changing market conditions and have been adding to holdings that they think are fundamentally attractive.

The managers believe strongly that their patience will be rewarded over the longer term. An NAV recovery would also likely be accompanied by a narrowing of BGUK’s discount, which is currently close to its five-year high.

In its first three years, Chrysalis Investments (CHRY) generated significant net asset value (NAV) and share price returns for investors by building an exciting portfolio of fast-growing, disruptive and potentially market-leading companies. An abrupt change in sentiment towards these types of businesses has since impacted on CHRY’s NAV, with falls in the values of listed investments and a notable write down in the valuation of Klarna. However, this is set against good news coming from portfolio companies such as Starling Bank and wefox.

In a market where financing for growth companies has become harder to obtain, CHRY is fortunate to have cash on hand from its first full exit to support portfolio companies, if needed. However, increasingly, these businesses are becoming profitable and cash-generative.

abrdn Private Equity Opportunities (APEO) has recently been trading at discounts to net asset value (NAV) in excess of 40%, way above its long-term average of around 16-17%, suggesting that the market is pricing in an NAV fall comparable to that seen during the global financial crisis.

Alan Gauld, APEO’s lead portfolio manager, thinks that the discount is nonsensical, and we agree. The listed private equity sector has changed immeasurably since the crisis and APEO’s portfolio is focused on managers of funds invested in cash generative businesses that are able to finance their growth.

It is coming up to two years since Redwheel (formerly RWC Partners) took over management responsibility for Temple Bar (TMPL), and performance figures show that the change has proven to be a good decision for the trust. Of course, the change in investor appetite from growth to value-style investing has helped it along its way, but the willingness of the managers – Ian Lance and Nick Purves – to go against the trend (by buying cyclical businesses at the lows, for example) shows the importance of stock-picking too. The managers say that valuations are a measure of appetite for risk, and that on that score we are back down to the lowest levels we have seen for about the past 25 years. In times like this (as seen during the global financial crisis, for example), they say, it pays to take on more risk.

Measures being taken to tackle inflation are weighing on markets. Reflecting this, JPMorgan Multi-Asset Growth & Income (MATE) has also been affected, with falls in its net asset value (NAV) and share price. However, living up to its objective (see below), these falls have not been as severe as those of global equity markets. In the current environment, MATE’s policy of growing its dividend at least in line with inflation should be attractive to investors. The managers have repositioned the portfolio to reflect the changed circumstances. They are looking for signs that the worst is priced in and markets are braced to recover, and will look to take advantage of this when the time is right.

Gulf Investment Fund (GIF) has built up an attractive track record of both absolute performance and outperformance of its index benchmark. For example, as we show on page 18, GIF outperforms competing open-ended funds over most time periods. Recent higher energy prices have bolstered sentiment toward the countries that comprise the Gulf Cooperation Council (GCC) – see below. Their governments are using the revenue windfall to fund vast infrastructure projects aimed at diversifying their economies. We think that this helps underpin the long-term case for an investment in the region and the fund.

After a few difficult years, the North American Income Trust (NAIT) has plenty to feel good about in 2022. It has enjoyed a turnaround in performance as its value style of investing has come back in favour. As we discuss on page 4, investors have been rotating away from growth stocks on the back of inflation fears. Acknowledging these fears, NAIT’s manager, Fran Radano, is confident that the trust can provide an income stream that should outpace US inflation. Meanwhile, the trust, which has been run in its current form since 2012, achieved ‘next generation dividend hero’ status this year (a commendation awarded by the Association of Investment Companies), as it has managed to increase its dividend every year for 10 consecutive years.

Shares in the good-quality growing businesses favoured by Montanaro UK Smaller Companies (MTU) have experienced a sharp selloff since the beginning of 2022, when interest rates began to rise in response to rampant inflation. Manager Charles Montanaro is focused on picking stocks for the long term rather than trying to second-guess macro trends. He and his extensive team have a strong dialogue with the management of these companies. He observes that high-quality, well-managed small businesses with strong market positions and pricing power have been able to pass on additional costs and are better able to cope with supply chain disruptions.

A sharp selloff in the share prices of the types of high-quality, growing companies favoured by JPMorgan Japanese Investment Trust (JFJ) has meant that the trust has given back much of its recent outperformance. The selloff mimics those of other countries such as the US and UK, but Japan is not afflicted by the high inflation or the threat of rising interest rates that triggered the stock market falls in other countries. JFJ’s managers are seeing opportunities to buy stocks that they favour on attractive valuations. They are also encouraged by the increasingly shareholder-friendly environment in the country; share buy backs and dividends are at record levels.

African property company Grit Real Estate Income Group (GR1T) has cleared a path for increased dividend distributions and net asset value (NAV) growth following a decisive piece of corporate action in the form of a heavily NAV dilutive capital raise. It has used the proceeds to bring its loan to value (LTV – borrowings plus cash as a percentage of portfolio valuation) under control and to expand its core business with the acquisition of a developer and asset manager.

GCP Infrastructure Investments Limited (GCP) recently published its half-yearly report covering the six months ended 31 March 2022. It was a period that saw GCP’s net asset value (NAV) hit a new high, and the end June NAV is higher still. Record electricity prices and stronger than forecast inflation contributed to this, but so too did the actions of the adviser. We look at the drivers of GCP’s returns in this note. The adviser sees potential for further NAV progression in coming months. The need to decarbonise the UK economy provides a supportive backdrop, and the adviser has identified a substantial pipeline of potential investments that should underpin the continued success of the fund.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

Appendix 1 – median performance by share price return over Q3 2022

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.