Investment Companies Annual Review 2021

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Another one for the history books

Just like the year before it, nobody is likely to forget 2021 in a hurry. The world remained consumed by the coronavirus pandemic and spread of new variants, but it was also the year we saw the largest global vaccine rollout in history. These were central themes remarked on by investment trust managers and chairs over the year – in addition to the knock-on effects of the reshaping of industries, inflation concerns and, in some countries, political turmoil and even scandal.

Here are some of the investment company highlights from 2021, which we explore in the note:

“UK property funds became more expensive over the year with the logistics, commercial and residential sectors all seeing their ratings strengthen”

“Baillie Gifford’s Schiehallion was the best performing trust in share price terms over 2021, boasting a return of 103% “

“The investment companies sector grew by over £40bn to £239.2bn in market cap terms, with market movements driving most of this”

At QuotedData, we:

- continued working from home, although introduced a flexible working policy when government restrictions allowed, while taking on additional clients throughout the year;

- published 65 notes on investment companies and property trusts, 8 more than in 2020;

- published our regular investment company and real estate monthly and quarterly roundups;

- shared the thoughts of our four analysts in our regular ‘QD view’ column;

- continued our weekly Friday news round-up and interview show, bringing together fund managers and experts from across the industry and giving you the opportunity to ask them questions;

- grew our profile in the press beyond our longstanding Citywire column, with a new column in i news, plus numerous articles and quotes published in both national and trade titles; and

- held a series of themed online conferences covering growth strategies, property and ESG.

We are pleased to announce our next live event will be the Master Investor Show 2022 which, provided government guidelines permit, will take place in London on 19 March. You can register your attendance here.

At a glance

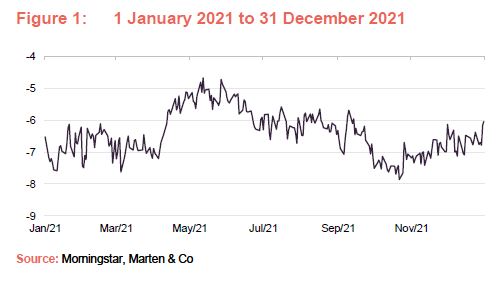

All investment companies median discount

Though not as dramatic as seen in early 2020, at the peak of the COVID-19 breakout, markets remained volatile throughout. Lock-downs and restrictions were eased – even lifted, at times – and the vaccine rollout has largely proven a success which has been reflected in narrowing discounts. The Omicron variant shook nerves in the winter months, but optimism is building that the worst is behind us.

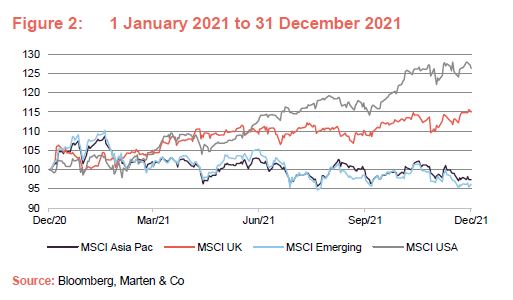

MSCI indices, rebased to 100

After being one of 2020’s winners, thanks to its success in controlling the spread of the virus, Asia suffered last year as the dominant Chinese market took a tumble. A stronger grip on COVID-19 and a clearer picture on Brexit gave the UK a much-needed boost, while the US continued to soar above all others, likely a result of its tech scene, which gained further traction from the new pandemic-induced lifestyle.

State of play at the end of 2021

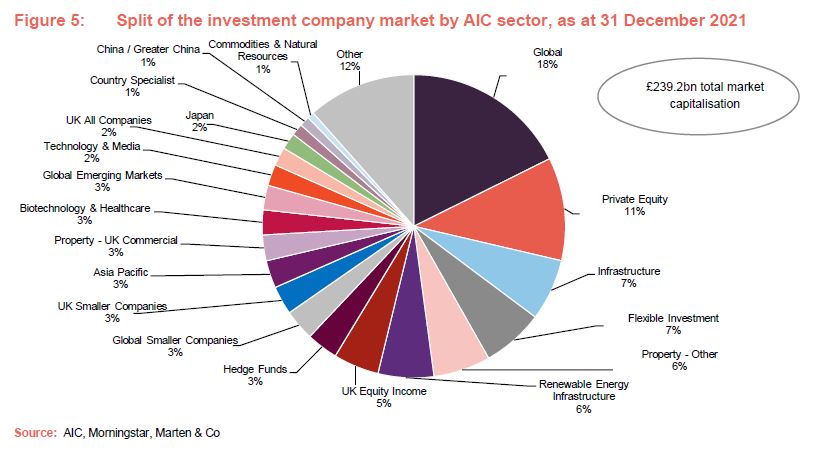

The investment companies sector grew from £198.3bn to £239.2bn over 2021 in market capitalisation terms, with market movements driving most of this. Figure 5 displays the relative composition of the industry by sector.

The Association of Investment Companies launched three new sectors in March, following a sector review. We saw the introduction of sectors dedicated to China/Greater China, India and Property – UK Logistics, while the remaining single country funds ended up in Country specialist. The Asia Pacific income sector was renamed Asia Pacific equity income.

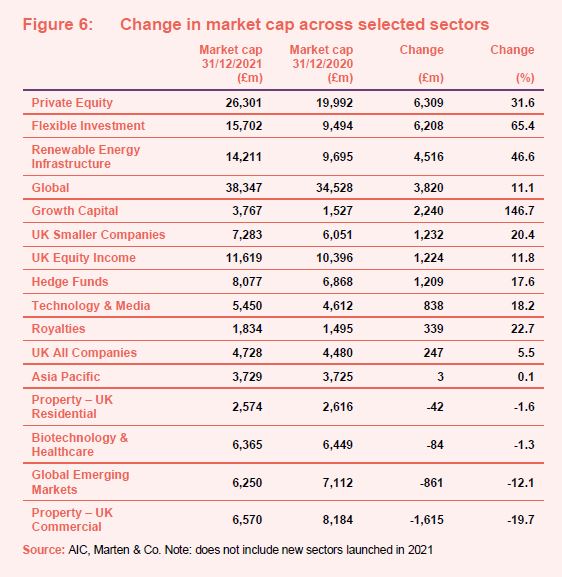

Proportionately, the growth capital and flexible investment sectors were those that grew the most over 2021, increasing by 147% and 65% respectively (see Figure 6). The private equity sector however grew the most in market cap value – by a huge £6.3bn to £19.9bn. The renewable energy infrastructure grew by 46.6% (£4.5bn) over 2021, having welcomed six new members.

On the negative side, the UK commercial property sector lost almost 20% of its value but remains one of the biggest sectors at £6.6bn. The biotechnology & healthcare, Japan, global emerging markets and insurance & reinsurance strategies sectors also saw their market caps fall over the year.

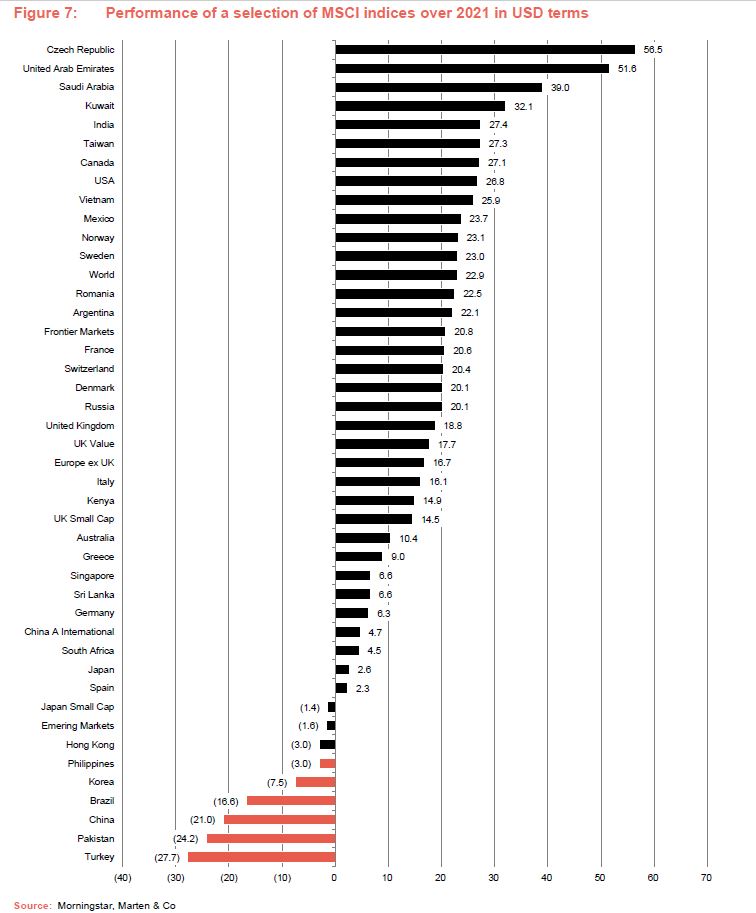

The average total price return for all investment companies over 2021 came to 15.1% – equity markets were strong as evidenced by a 22.9% return for the MSCI World Index (see Figure 7) over the same period, but remember that large parts of the investment companies market are invested in asset classes other than equities.

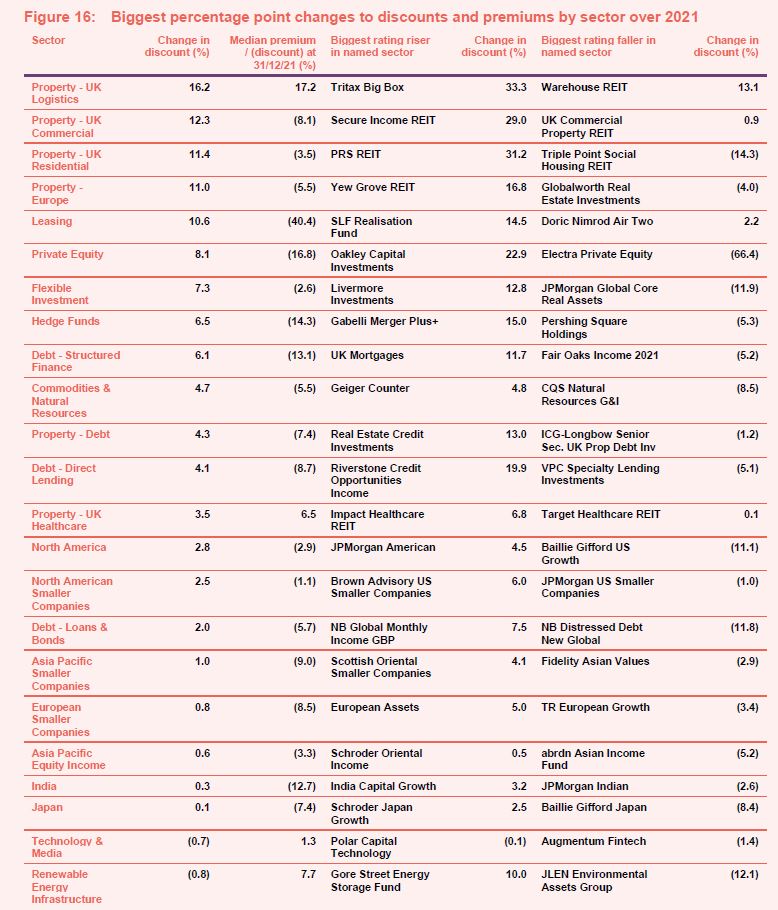

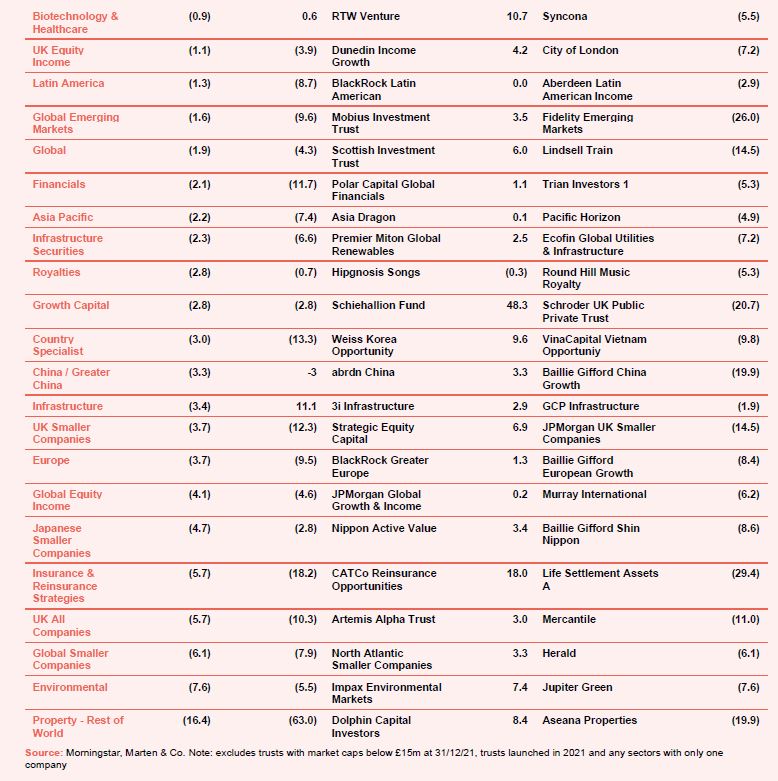

Narrowing discounts

Meanwhile, the average discount of all investment companies narrowed from 9.3% to 8% over 2021, while the median discount also narrowed from 6.8% to 6%. Notably, discounts tightened/premiums increased across the Property – UK logistics, Property – UK Commercial and Private equity sectors – they became ‘more expensive’ relative to NAV, with the latter’s median discount of 24.9% as at 31 December 2020, narrowing to 16.8% by the end of 2021. On the other hand, the rest of the world property, environmental, global smaller companies and UK all companies sectors swung the most in terms of becoming ‘cheaper’ relative to NAV. Baillie Gifford’s Schiehallion saw the biggest change in its discount/premium level, having started the year trading on an 11.1% premium and growing to a 59.3% premium by 31 December 2021.

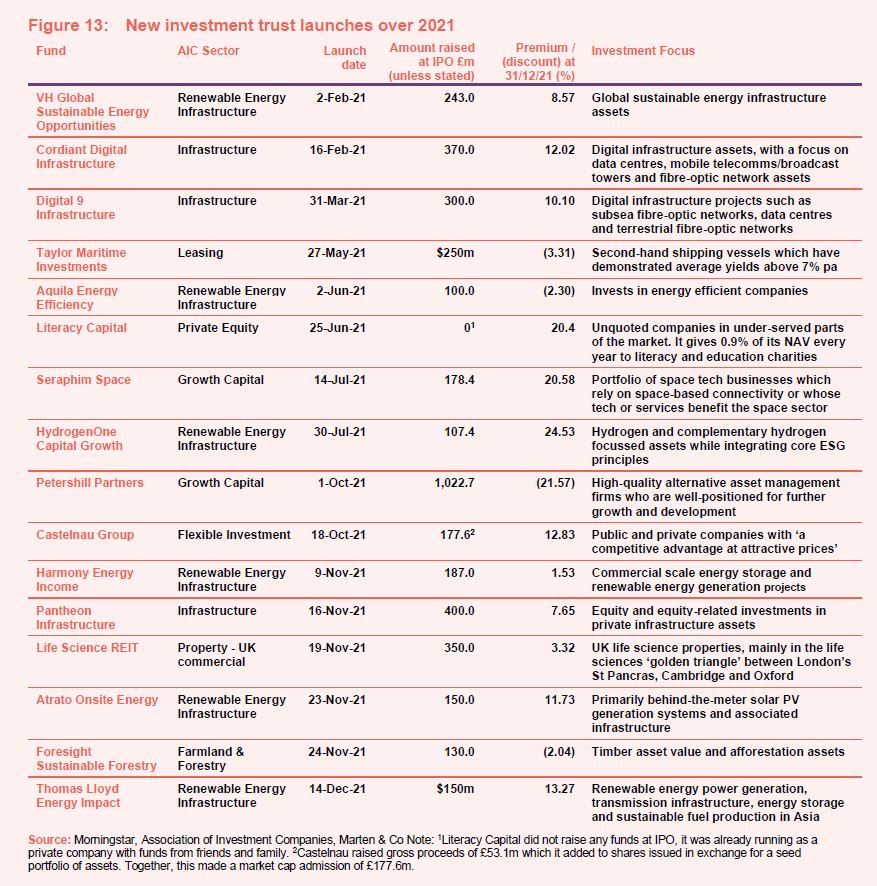

The number of investment companies overall grew by six to 337 in 2021. While there were 16 IPOs throughout the year – the first time double digits have been reached since 2018 – there were also a number of de-listings. The launches brought in £4bn of new money (plus a further £1.1bn later in the year for some of these trusts) while existing funds did well to bring in about £11.6bn through the secondary market.

Performance data

As we highlighted in our last annual review, the pandemic set forth perhaps one of the most idiosyncratic periods in financial markets history. While markets settled in 2021, volatility remained, rearing its head in different regions as the pandemic spread across the globe in waves. Added to the mix has been the threat of rising inflation and rising interest rates, which many commentators say will continue into 2022. Meanwhile, the pandemic had an unwelcome knock-on effect on supply chains across the world which has impacted almost every industry. This has been exacerbated in certain regions due to other factors such as in the UK and Europe, which are still learning to navigate the consequences of Brexit.

On the plus side, society continued to embrace technology last year and economies around the world learnt from 2020’s mistakes and managed to keep things ticking along as people became accustomed to a pandemic-induced lifestyle.

Figure 7 shows the performance of a selection of MSCI indices over 2021 in US dollar terms. India, Taiwan and the US were among the year’s winners, despite high COVID-19 numbers and one of the world’s deadliest waves experienced in India in the second quarter of the year. A swift recovery in dividends and some clarity over Brexit helped to keep the UK in the black. After a strong 2020, Asia suffered last year, with China among the biggest laggards.

Performance by sector and fund

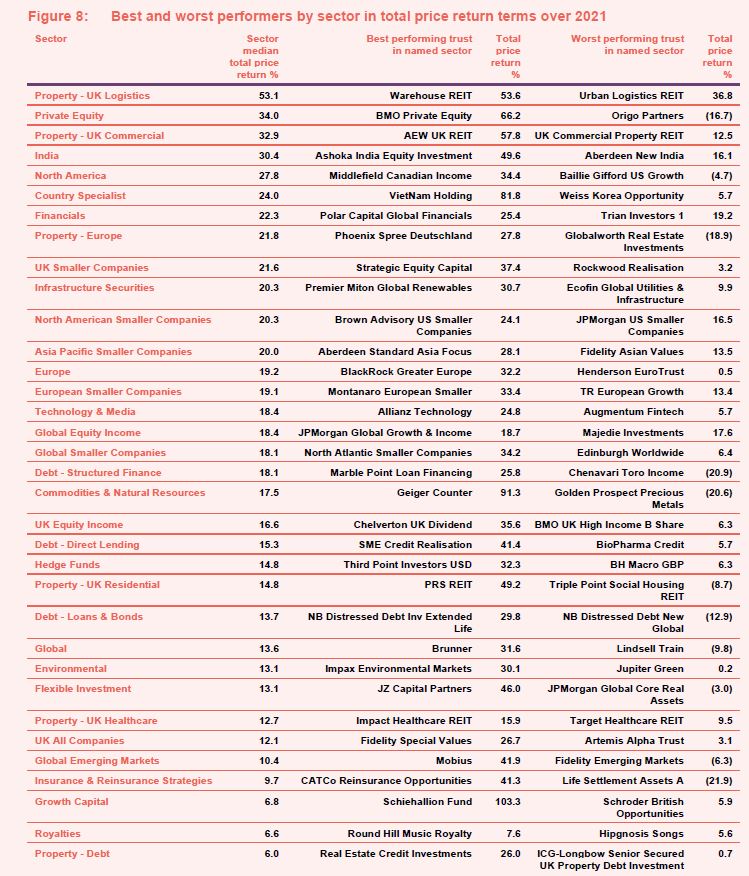

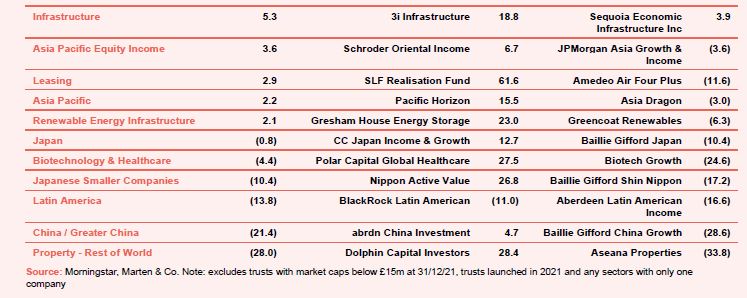

Figure 8 shows how each of the investment company sectors performed throughout 2021 in median price total return terms, and the best and worst-performing funds in each sector. Out of the 49 sectors listed, 43 delivered a positive return, compared with just 26 over 2020.

The best performing sector for the year was Property – UK logistics, with a share price return of 53%. This was followed by private equity and Property – UK commercial which delivered 34% and 33% respectively. At the bottom of the table were the rest of the world property, China/Greater China and Latin America sectors, down 28%, 21% and 14% respectively.

India was the strongest regional sector for the year with no members suffering a total loss over the course of 2021. The standout performer was Ashoka India, with a return of 50%, helped by small cap stocks outperforming large cap ones in that market; Aberdeen New India returned 16%. Despite suffering from a deadly COVID-19 wave in May, India’s government allowed businesses to continue to operate and its economy bounced back the following month and reported the strongest numbers globally.

North America also performed well, with a median price return of 27.8%, its strongest performer being Middlefield Canadian Income which gave investors a 34.4% return on their money.

The commodities & natural resources sector started the year on a high before struggling for the remaining six months as slower Chinese growth weighed on demand. The sector often found itself at the bottom of performance tables (see our monthly roundups over 2021). However, by the year-end it had achieved a median sector price return of 17.5% and member Geiger Counter was the second-best performer out of all investment companies, delivering a huge 91.3%. Its success came from its focus on uranium, while precious metal and oil-exposed sector peers found it tougher going. Golden Prospect Precious Metals was the worst performer in the sector, down by 20.6%.

The crown for first place for share price total return however goes to Schiehallion, which rose by a staggering 103%. The Baillie Gifford-managed trust, which saw its market cap more than double over the course of the year from £492m to £1bn, sits in the growth capital sector, which rose by a median 6.5% over 2021. The lowest return in that sector was still a positive 5.9% from Schroder British Opportunities.

After an excellent 2020, Japan strategies had a tough year, initially as the country struggled to get its vaccination programme up and running, with the Japan sector down 0.8% and Japanese smaller companies down 10.4%. Value/activist funds like Nippon Active Value fared better, delivering 26.8%, but the growth-focused Baillie Gifford Shin Nippon fell by 17.2%.

Chinese funds also took a U-turn in 2021. Many China strategies were among the best performers in 2020 but the sector suffered a 21.4% loss last year. The government’s apparent undermining of its tech sector (with measures such as anti-trust investigations), many large property developers failing to cope with excessive debt, stringent anti-COVID measures and geopolitical tensions all weighed on the market.

Somewhat surprisingly, the biotechnology & healthcare sector also suffered in 2021, with a median sector loss of 4.4%. Biotech Growth was the worst performer with a loss of 24.6%. Worries about a Democrat government slashing drug prices and the COVID-19 disruption to clinical trials played a part in this. In addition, the impact of disruption to supply chains has been an issue as much for the healthcare sector as it is for other industries, with costs having jumped considerably since before the pandemic.

Best performing trusts

As already discussed, Schiehallion and Geiger Counter had a stellar year in 2021, but not far behind them was VietNam Holding, which delivered a sensational 81.8% price return. Vietnam has been described as Asia’s emerging champion and you can read more about the trust and the region in our latest research note here. Other strong performers in price terms, helped a great period for sales of investments, were private equity names BMO Private Equity and NB Private Equity Partners Class A. Soaring shipping rates helped Tufton Oceanic. Property funds AEW UK REIT, Warehouse REIT and Tritax Big Box also had a great 2021 as COVID fears receded but the boom in online shopping persisted.

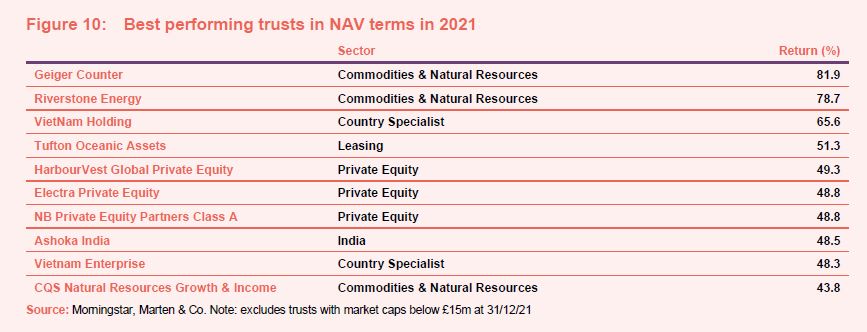

In NAV terms, Geiger Counter topped the table with a return of 81.9% (see Figure 10) followed by its sector peer Riverstone Energy. After a tough 2020, a recovering oil price fed through into its NAV. The manager also made some progress with the gradual repositioning of the portfolio away from fossil fuels.

VietNam Holding also made the top NAV performers for the year and was joined in the table by fellow Vietnamese fund Vietnam Enterprise. Significant foreign investment is boosting the country’s manufacturing sector. Consumer incomes are rising and this is expected to feed through into higher consumption. An easing of restrictions on foreign investors could allow the stock market to be upgraded to emerging market status. Meanwhile, Ashoka India, which we discussed above, also made the table.

As already touched on, the private equity sector had a strong year, HarbourVest Global Private Equity, Electra Private Equity and NB Private Equity Partners Class A all made the top ten best performers in NAV terms. HarbourVest reported its strongest NAV per share growth in any interim period for the first half of 2021, which it said was a result of being well-placed to capture emerging technological and thematic trends.

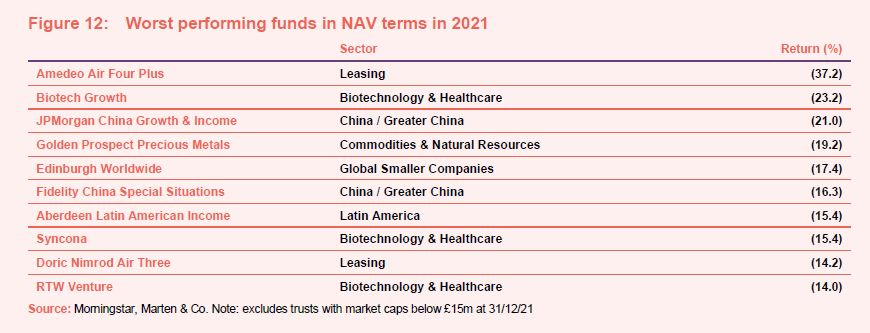

Worst performing trusts

On the negative side, property funds outside of the UK didn’t fare too well in 2021 (see Figure 11), with Aseana Properties, Macau Property Opportunities, Ceiba Investments and Globalworth Real Estate Investments among the biggest laggards in share price terms. Macau has been in realisation mode since 2016 but this has been met with delays due to COVID-19 while Aseana has gone back and forth in recent years on whether it will continue as an investment company.

Meanwhile, China/Greater China trusts Baillie Gifford China Growth and JPMorgan China Growth & Income also suffered in 2021 for the reasons that we have already outlined.

Edinburgh Worldwide also makes this list. Like many other Baillie Gifford funds which also have a growth focus, it was hit by the sell-off in growth stocks towards the back end of the year. Rising inflation is raising expectations for a series of interest rate hikes in 2022. That has a knock-on effect for stocks valued on a discounted cash flow basis – a higher discount rate (influenced by higher interest rates) means a lower valuation. Higher inflation should have been good news for the gold price and hence Golden Prospect Precious Metals. However, it feels as though investors drove up the price in anticipation of inflation and sold when it manifested itself.

In NAV terms, as shown in Figure 12, Amedeo Air Four Plus was the worst performer. The trust focuses on the aircraft leasing space which has come under pressure over the past two years due to travel disruptions created by the pandemic. This has also hit Doric Nimrod Air Three. Chinese (JPMorgan China Growth and Income and Fidelity China Special Situations) and biotech (Biotech Growth, Syncona and RTW Venture) strategies feature again, for reasons already discussed. Syncona did secure an NAV uplift at the end of the year from its sale of its stake in Gyroscope that is not reflected in these numbers.

Money in and out

2021 delivered 16 new issues (listed in Figure 13), raising gross proceeds of about £4bn at their IPOs. A further £1.1bn was raised by this group plus around £11.6bn of net new money was raised by existing funds in the secondary market. Meanwhile, there were £2.3bn of outflows, bringing total net flows to more than £14bn. This compares with £5bn total net inflows in 2020.

IPOs

Petershill Partners takes the prize for 2021’s largest new issue. It was a pre-existing fund – investing in alternative asset funds and the managers behind them – that decided to list on the London Stock Exchange. At IPO, it sold £547m worth of new shares and placed £617m of existing shares with new investors. Altogether, it started life as a listed company with a market capitalisation of about £4bn. We don’t think the fund is well-understood by investors, which we think is the main reason it is now trading on a double-digit discount.

Renewable energy continued to prove popular and it was exciting to see the sector branch out into hydrogen (HydrogenOne), Asian renewables (ThomasLloyd Energy Impact) and dedicated rooftop solar (Atrato Onsite).

We also saw a new subset of infrastructure emerge as two funds focused on digital infrastructure listed and then rapidly expanded. Pantheon Infrastructure, one of the sector’s most successful new issues in 2021, may also have some exposure to this area. Funds focused on space technology, forestry, and life science property further diversify the sector and we are excited to see how these fare in coming years.

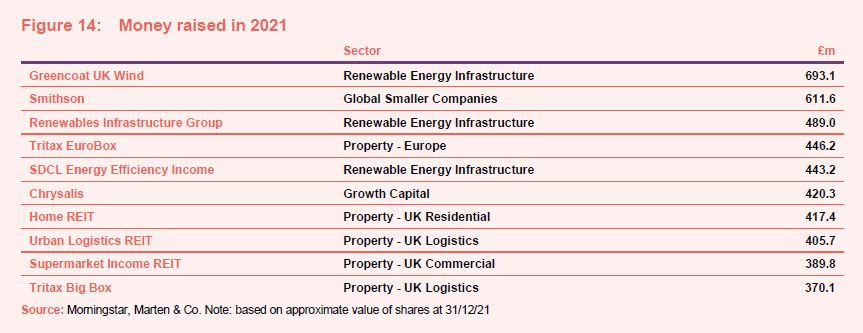

Money in and out of existing funds

Though some trusts which only came to market in 2021 went on to raise further funds during the year, including Cordiant Digital Infrastructure and Digital 9 Infrastructure, these have been omitted from Figures 14 and 15, which show the approximate value of shares issued or redeemed as at 31 December 2021, as we want to focus on companies that were already in existence prior to 2021 for this section.

Money coming into existing funds

Despite the uncertainty that loomed during 2021, investment trusts shot the lights out during the year and certain strategies proved especially popular.

Renewable energy infrastructure was the clear winning sector for the year, not least because six of the 16 new issues fell into the space. Three of the biggest fundraises within the secondary market also came from such mandates. At the top of the list was Greencoat UK Wind, which launched an institutional placing just shy of £200m in February before raising a further £450m in November – which exceeded its initial £396m target. It has been using this firepower to build its exposure to offshore wind. Meanwhile, the Renewables Infrastructure Group and SDCL Energy Efficiency Income raised £490m and £443m respectively. SDCL’s £250m fundraise in September was well oversubscribed.

Demand for Smithson’s shares continues unabated, despite relatively modest returns from the trust in 2021.

The logistics boom supported sizable fundraises by Tritax Bix Box and Urban Logistics REIT.

Chrysalis raised £420m in 2021 to back growing companies, most recently via a placing and offer with fundraising platform PrimaryBid (which is offering retail investors access to issues that were previously hard to access).

It was great to see Home REIT raise £400m, which will be deployed into accommodation for homeless people in the UK. Social impact investing appears to be of increasing importance to investors.

Supermarket Income REIT, which had already raised a remarkable £140m in 2020, raised almost £400m last year on two separate occasions, with the most recent bringing in £200m in yet another oversubscribed issue.

A further 26 trusts issued shares worth at least £100m over 2021 including Polar Capital Global Financials, Hipgnosis Songs, Octopus Renewables Infrastructure, Ruffer, BB Healthcare, BlackRock Throgmorton, Pacific Horizon and Gresham House Energy Storage.

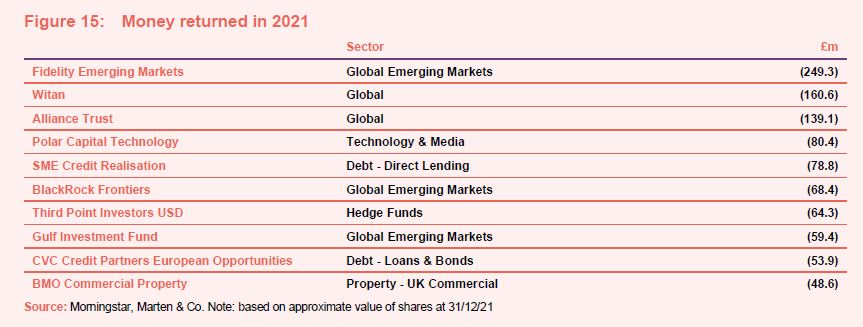

Money going out of existing funds

The biggest outflows over 2021 were from Fidelity Emerging Markets (formerly Genesis Emerging Markets) which saw a rush to take up its 25% tender offer (made in conjunction with the move of the manager from Genesis to Fidelity). 103,326,957 shares were validly tendered – which was 85% of all shares in issue.

BlackRock Frontiers also completed a tender offer in April which saw almost £70m returned to shareholders while Gulf Investment Fund shrank at the start of the year as 44% of its shareholders opted for the exit in a tender which was held in December 2020 and completed in January 2021.

Share buybacks were led by Witan, Alliance Trust and Polar Capital Technology.

Liquidations, de-listings and trading cancellations

In 2021, we said goodbye to RDL Realisation, Alternative Credit Investments, Acorn Income, Jupiter UK Growth, Gabelli Value Plus+ and St Peter Port Capital. City Merchants High Yield merged with Invesco Enhanced Income to create Invesco Bond Income Plus and BH Global merged with BH Macro. Invesco Income Growth also merged with Invesco Select and Aberdeen New Thai and Aberdeen Emerging Markets were merged to form abrdn China.

In real estate, GCP Student Living was taken over and Yew Grove REIT was bought by Slate Office REIT. Drum Income Plus REIT was also taken over by Custodian REIT.

Meanwhile 2021 also saw Rockwood Realisation (formerly Gresham House Strategic) announce its plans to wind down after a lengthy strategic review and it remains in the process of doing so.

Later this month Scottish Investment Trust will merge with JPMorgan Global Growth & Income and Electra Private Equity will cease to trade and will relist on AIM as Unbound Group.

Significant ratings changes

Figure 16 shows how discounts and premiums moved over 2021, and therefore whether certain sectors and trusts became more expensive or cheaper. Most UK-focused sectors became cheaper over the year, although, within these, some trusts saw significant positive rating changes such as Strategic Equity Capital (UK smaller companies) which saw its rating improve by 6.9%.

UK property trusts on the other hand topped the table, with logistics, commercial and healthcare names generally becoming more expensive. The UK logistics sector’s median rating improved by 16.2%, likely swayed by Tritax Big Box which saw its own rating improve by 33.3% over the course of 2021. While the UK commercial property sector ended the year on a median discount of 8.1%, this was a significant narrowing from 20.4%.

Secure Income REIT saw its 20.2% discount dramatically improve to a 8.7% premium by the end of the year and PRS REIT’s 20.3% discount ended the year on an 11% premium.

Though levels remain wide, private equity trusts closed the year strongly with discounts narrowing to a median of 16.8%. The best performer from the sector was Oakley Capital Investments which saw its rating improve by 22.9%.

The biggest discount improvement was seen by Schiehallion, which we already know also boasted the best share price return for the year. The trust’s 11% premium rose by a huge 48% to end the year at 59%. The trust, which sits in the growth capital sector, exceeded its launch investment target at the start of the year and the managers have often shared how wide their opportunity set is.

At the other end of the table, rest of the world property trusts saw their already double digital median discount widen further to a median discount of 63% at year-end while environmental trusts saw their median sector premium swing into a discount by 31 December 2021.

Elsewhere, the flexible investment sector shed some of its premium rating to end the year at a median premium of 2.6% while the biotechnology & healthcare sector was threatened at the discount boundary as a 1% down rating pushed its median sector premium to 0.6% at year-end.

Major news and views from 2021

Portfolio developments

- SDCL Energy Efficiency Income sealed a deal with the UK’s largest operator of public electric vehicle charging points

- Ruffer discussed its decision to invest in bitcoin

- JLEN Environmental Assets expanded its remit

- Taylor Maritime completed the deployment of its IPO proceeds

- Schroder UK Public Private made its first new investment since the new manager’s December 2019 appointment

- US Solar refinanced legacy loans in its Heelstone Portfolio

- Invesco Perpetual UK Smaller Companies was hit by dividend expectations

- Polar Capital Technology was held back by its widening discount

- India Capital Growth posted strong results before redemption vote

- JPMorgan Emerging Markets achieved record outperformance

- Keystone Positive Change reported on its transition year

- A low exposure to China helped Schroder Oriental

- Henderson Diversified Income embedded ESG

- Disappointing year for Finsbury Growth and Income

Corporate news

- Cordiant Digital’s IPO raised £370m

- Digital 9 Infrastructure’s IPO raised £300m

- ICG Longbow’s wind-down was approved

- BlackRock North American Income revealed a revised objective and name change to BlackRock Sustainable American Income

- An activist Investor publicised plans to block the continuation of Crystal Amber

- Seraphim Space launched with £178.4m

- Foresight Sustainable Forestry shared IPO plans

- Petershill Partners announced its intention to float

- SDCL Energy Efficiency raised £250m

- Third Point Investors announced plans to borrow $150m as it declined a second EGM requisition

- Pantheon Infrastructure targeted a £300m IPO

- Greencoat UK Wind raised £450m

- Atrato Onsite Energy’s IPO was oversubscribed

- Gresham House Strategic announced a managed wind-down

Managers and fees

- Scottish Mortgage’s James Anderson announced his retirement

- Charlie Thomas, manager of Jupiter Green, left Jupiter

- Ewan Markson-Brown, co-manager of top-performing Pacific Horizon trust left Baillie Gifford

- Genesis Emerging Markets appointed Fidelity as its new manager

- The Association of Investment Companies appointed ex Share Centre boss Richard Stone to replace Ian Sayers as CEO

- Aberdeen Emerging Markets and Aberdeen New Thai announced plans to combine and focus on China as one trust

- Schroder UK Public Private’s Ben Wicks stepped down

- Scottish Investment Trust was taken over by JPMorgan Global Growth and Income

Property news

- Tritax EuroBox was assigned investment grade credit rating by Fitch. It also raised €230m in oversubscribed placing

- RDI REIT was the subject of a £467.9m takeover approach

- AEW UK REIT won its legal battle over unpaid rent

- British Land moved into logistics development

- Urban Logistics REIT raised £108.3m

- UK Resident REIT failed to hit its IPO target

- Custodian REIT was in talks to buy Drum Income Plus REIT

- Civitas Social Housing was targeted by a short-seller

- abrdn European Logistics Income raised £125m in an oversubscribed issue

- Capital & Regional restructured its debt

- Life Science REIT raised £350m at IPO

Selection of QuotedData views

- Opportunities on the forefront(iers) – 10 December

- Feel-good investing – 12 November

- Wake up and smell the COP26 – 29 October

- HOME run and a strike-out? – 24 September

- Something in the water – 3 September

- UK glass half-full? – 27 August

- Space! – the not so final frontier – 11 June

- Spotlight on logistics development – 7 May

- Indian funds take stock – 30 April

- There’s more to emerging markets than China – 26 March

- From infectious enthusiasm to IPO fever? – 12 February

- Reasons to be cheerful – 22 January

Investment company notes published in 2021

Outlook for 2022

Here are some recent comments from managers and directors drawn from our latest economic and political summary that you may find interesting.

On the global economy:

James Harries, manager of Securities Trust of Scotland, noted that: “The jury is still out as to whether the trauma and related policy response of COVID-19 has kickstarted a new cycle rather than extended the current one. Our view is given that we have not seen a credit event we are still in the same cycle that started in 2008/9 and continues to this day. Our relative performance tends to be best at times of stress and we may need to wait until this cycle completes to fully demonstrate the value of our approach.

“Inflation has also become a concern. We are keeping an open mind as to whether or not these worries are misplaced. We acknowledge that demand is currently strong driven by both policy and pockets of pent-up spending at a time when supply is struggling to respond. Balanced against this are the structural factors that have kept inflation low. These have intensified; debt levels have exploded, populations have aged further and technological disruption continues apace.

“It is impossible to know the outcome of this complex conundrum. As such we are not managing the portfolio based upon an inflation forecast. What we can be more convinced about is that interest rates cannot rise too much as there is simply too much debt. This leaves us with two possible outcomes. Either inflation dissipates or it remains persistent, but in both cases interest rates remain low. In the first instance, as supply disruptions normalise and inflation expectations peak, input costs will likely moderate. This will benefit our portfolio.

“In the second instance, if inflation is more persistent, but interest rates remain low, we will face an ongoing negative real interest rate environment (as inflation continues to exceed the level of interest rates). This favours an index-linked security or, dare I say it, a portfolio of high quality businesses that will likely be able to raise prices over the longer term.

“This ability to raise prices stems from the same competitive advantages that allow for high returns on capital. In this scenario we believe that we are once again well placed. Although many of the sorts of businesses in which we invest are considered nominal bond proxies, in the sense that over short periods they are correlated with interest rates, over the longer term they are much more akin to an index-linked bond.”

On the UK:

James Henderson and Laura Foll, co-managers of Lowland, said: “There are large structural changes happening in the economy. The move away from fossil fuels, the changes in work practices brought about by COVID and the long-term consequences of the UK leaving the EU will lead to fundamental changes in the UK economy. For companies these changes present both challenges and opportunities. It is a very exciting time to observe business models being rethought. As investors in this time of extreme change we need to keep with a relatively long list of diverse holdings in large, medium and small companies. The speed of change is such that some companies will fail to adapt fast enough, while others will grow into substantial businesses if they are supplying excellent and required goods or services.

“As well as the large structural changes, the era of ultra-low interest rates might be ending as inflationary pressures build. For instance, the move to a lower carbon economy will require substantial investment across much of the economy. During this period there will be transitional costs as new technologies reach commercial scale. These inflationary pressures will be a challenge for economic policy makers for the foreseeable future. The companies that succeed in a period of rising inflation are those that have a differentiated offering that allows them to increase prices, so as to counter supply price increases and preserve margins. Companies that can do this are a very good hedge against inflation.”

On China:

Rebecca Jiang, Howard Wang and Shumin Huang, managers of JPMorgan China Growth and Income, said: “COVID remains a threat to the economic outlook. China approved its first domestic vaccine in December 2020 and well-organised vaccination programmes ensured that by September 2021, 78% of the population had been vaccinated. A few scattered outbreaks of the virus have been quickly contained. However, while China’s success in controlling COVID is applaudable, it remains one of the few countries in the world still committed to a COVID-zero policy that has kept external borders closed. It is unclear when borders will re-open to tourists and business travellers and this has cast a shadow over the outlook for the domestic service sector.

“Since recovering from the initial shock of the pandemic, China has maintained a neutral monetary policy aimed at stabilising credit expansion. The implementation of strict controls on borrowing by property developers, to curtail speculative activity, is a key part of this policy. These measures, together with restrictions on homebuyers, contributed to the de facto defaults of several developers in September 2021, including Evergrande, one of the country’s largest private property companies. The government plans to deal with these problems at the individual project level, rather than via corporate level bailouts, in part to avoid encouraging reckless commercial behaviour by developers. In our view, and that of other local investors, this is not China’s ‘Lehman Brothers moment’, and is unlikely to trigger systemic ructions. Most of the debt is backed by land and does not involve the kind of complex financial derivatives whose high contagion risks sparked the 2008 global financial crisis.

“Chinese regulatory crackdowns on other sectors have also been creating headlines around the world. The emphasis of government policy seems to have shifted from growth-centred policies to regulatory crackdowns designed to achieve more balanced growth. The digital economy and other socially sensitive industries such as education and health care have been most impacted. The shift began in November 2020 with the high-profile suspension of the Ant Group initial public offering (IPO), due to concerns about its capital structure, its ballooning consumer finance business and conflict with regulators. Then, in July 2021, regulators announced a flurry of new restrictions, including on the private tutoring industry, whose business model was essentially destroyed by the crackdown.

“Since then, Chinese regulators have announced tighter controls on anti-competitive behaviour, data security and companies employing gig workers, and non-compliance has been swiftly punished. In the health care sector, we have long championed structural trends such as import substitution and the increasing availability of advance therapeutics, and these are playing out nicely. However, certain sub-sectors such as medical devices and equipment are facing increasing pressure from government procurement policies to cut prices. This is in part intended to reduce corrupt pricing practices which benefit suppliers, distributors and hospital administrators, and should be welcomed by investors. Nonetheless, these regulatory shocks have triggered a selloff in stocks in the property, internet, education and healthcare sectors, all of which are popular with foreign investors.

“The crackdowns may seem abrupt and severe, but in our view, controls on many sectors lagged regulations imposed by the EU and US authorities, and China is simply playing catch-up. Some restrictions have also been motivated by the government’s recent promotion of ‘common prosperity’. This has raised concerns among investors and observers that China is intent on ‘soaking the rich’, but we disagree with this assessment. On the contrary, China has one of the highest levels of income inequality among the world’s major economies, and a more balanced distribution of wealth is critical to ensuring long-term growth.

“Environmental regulations are also generating some public concern and criticism. In September 2020, President Xi committed China to achieving ‘net zero’ carbon emissions by 2060. However, a year on from this pledge, efforts to reduce carbon emissions are being blamed for contributing to recent widespread power shortages. High coal prices and an inflexible power pricing mechanism have also played a role in the shortages, which have been particularly damaging for energy intensive industries such as steelmaking and cement, adding to inflation in basic material prices. The power shortages caused a public outcry that alarmed officials, leading to some retuning of energy policy, although the government remains committed to its net zero target.

“Elsewhere, the US Federal Reserve has become increasingly hawkish, due to higher-than-expected inflation, and this has put upward pressure on the US dollar. Trade tensions between China and the US have eased under the Biden administration. However, fundamental differences on trade and other issues persist between the two countries and taking a tough stance against China has bipartisan support in the US.”

On biotech & healthcare:

James Douglas and Gareth Powell, managers of Polar Capital Global Healthcare, added: “The impact of the COVID-19 pandemic on healthcare will be felt for many years, on top of the fact that the virus is likely to become endemic. In terms of structural changes, there has been a big pick-up in R&D in pharmaceutical and biotech companies, not just on infectious diseases, but across other areas in response to the innovation and progress that has been witnessed over the last five years. The enormous amount of money that has moved into life sciences venture capital over the last two years is evidence of the enthusiasm around the industry and the benefits that it can bring through the discovery of new drugs that can dramatically change patients’ lives. The impact of vaccine development against COVID-19 has been the accelerant for greater R&D spend and there will be many companies that benefit, particularly those focused in life sciences tools and services, clinical research organisations and contract manufacturers.

“In the shorter term, the impact on supply chains is an issue as much for the healthcare sector as it is for other industries, with costs having jumped considerably since before the pandemic. Also on the labour side, the pandemic has driven a sea change in what employees want and expect from their jobs, which is having a significant impact on healthcare. A recently published survey highlighted that 18% of US healthcare workers quit their jobs during the pandemic, with 79% of healthcare professionals saying that the national employee shortage has affected them and their place of work. Not only are positions being left vacant, but providers are also seeing a significant spike in wages. This is likely to remain a challenge for many organisations for the next 12 to 18 months.

“The disruption in healthcare delivery that started several years ago has been another area that has seen an acceleration driven by the pandemic. The shift of care to lower cost settings and away from the large in-patient hospitals is a must if healthcare systems are to become more efficient. With hospitals being at the centre of managing patients affected by COVID-19, care for other conditions has naturally moved away from the hospital with other providers such as ambulatory care, outpatient and home healthcare experiencing a significant boost in demand. This trend will continue, but many of the companies in these areas are being impacted by the wage inflation and employee shortages, a situation that needs to improve if they are to cope with the acceleration in demand.

“Backlogs have increased dramatically due to the pressure of the pandemic on healthcare system, most visibly on the elective side for procedures such as hips and knees. Here in the UK, for example, the British Medical Association estimates that between April 2020 and July 2021, there were 3.79 million fewer elective procedures.”

We wish you good luck and good health with all your endeavours in 2022!

Ed, James, Matt, Jayna, Richard, Dave, Milly, Cerasela, Emma, Robin, Colin, Nick, Sahib, Brice, Jack, Jemima and Henrietta

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.