Investment Companies Annual Review 2020

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

In this issue

- State of play at the end of 2020

- Performance

- Money in and out

- Significant rating changes

- Major news and views from 2020

- Outlook for 2021

- Investment company notes published in 2020

- Legal

A year that changed the world

It was the year that nobody will forget. Industries re-shaped, many of them probably permanently, a change of leadership in the US, and finally a remarkable feat of human ingenuity in the roll-out of several vaccines by the year-end, are just some of the many themes touched on by managers and chairs in this final monthly roundup of 2020.

Here are some of the investment company highlights from 2020, which we explore in the note:

- “Baillie Gifford had a year to remember, with the three best performing funds of the year, Baillie Gifford US Growth, Pacific Horizon, and Scottish Mortgage”

- “The investment companies sector grew by over £20bn to £199.3bn, in market capitalisation terms, with market movements driving most of this”

- “The royalties sector made the biggest leap, as a percentage of market capitalisation at the start of 2020. Hipgnosis Songs raised over £750m and we also had the launch of Round Hill Music Royalty”

At QuotedData, we:

- Managed the move to working from home seamlessly, taking on additional clients throughout the year;

- Published 57 notes on investment companies, 5 more than in 2019 (see the Investment company notes section below), as well as our regular monthly and quarterly publications. We also published several IPO notes for funds attempting to launch;

- Built out an enhanced real estate service that includes monthly, quarterly, annual and thematic writeups – you can refer to these for news and analysis of property funds;

- Launched a weekly Friday news round-up and interview show, bringing together fund managers and experts from across the industry; and

- Held a series of themed online conferences covering growth strategies, property and ESG. The next in the series, spread over four days and covering funds in Europe, Americas, Asia and the UK, launches on 3February.

At a glance

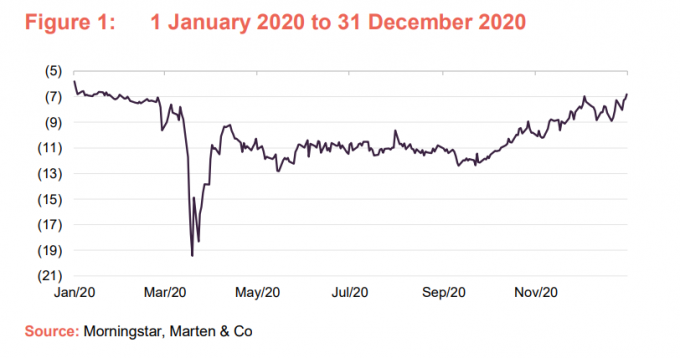

As news filtered out about the virus in Wuhan, markets became more nervous. Full-on panic took hold in March 2020 and this hit discounts. The swift action of central banks injected some calm but the lock-downs were causing problems in some sectors and this was reflected in discounts. Confidence picked up noticeably after the positive news on vaccines. Figure 1 looks at movements in the median discount of investment companies over 2020.

All investment companies median discount

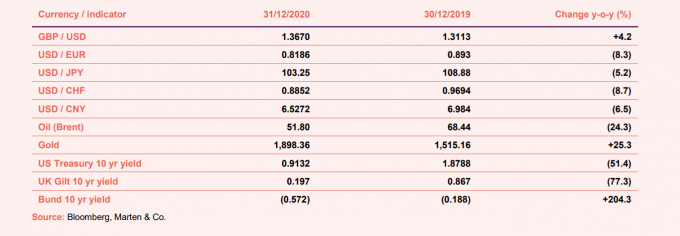

While each of the indices was hit by March’s pandemic panic, the success that much of Asia had in controlling the spread of the virus was a big factor in the returns of equity markets in the region (notably China). The only real laggard was the UK, where Brexit worries and failures in the handling of the virus continued to weigh on share prices. Figure 2 looks at movements in a selection of MSCI indices over 2020.

MSCI indices, rebased to 100

State of play at the end of 2020

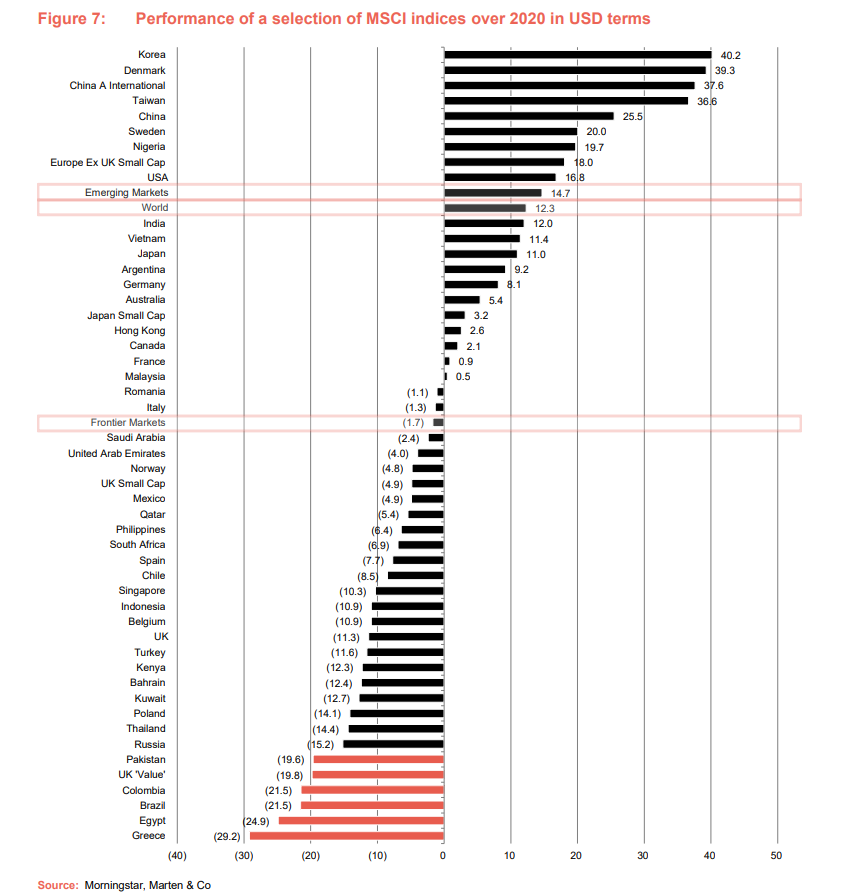

Out of the 329 investment companies that were in existence at the beginning of 2020 and ended the calendar year with market caps above £15m (the cut off we have used to exclude smaller trusts for comparative purposes), the average total price return over 2020 came to 6.3% (the MSCI World Index increased by 12.3% – see Figure 7). It was a remarkable turnaround from the depths of late-March, as decisive central bank intervention on an unprecedented scale prevented a complete collapse in markets.

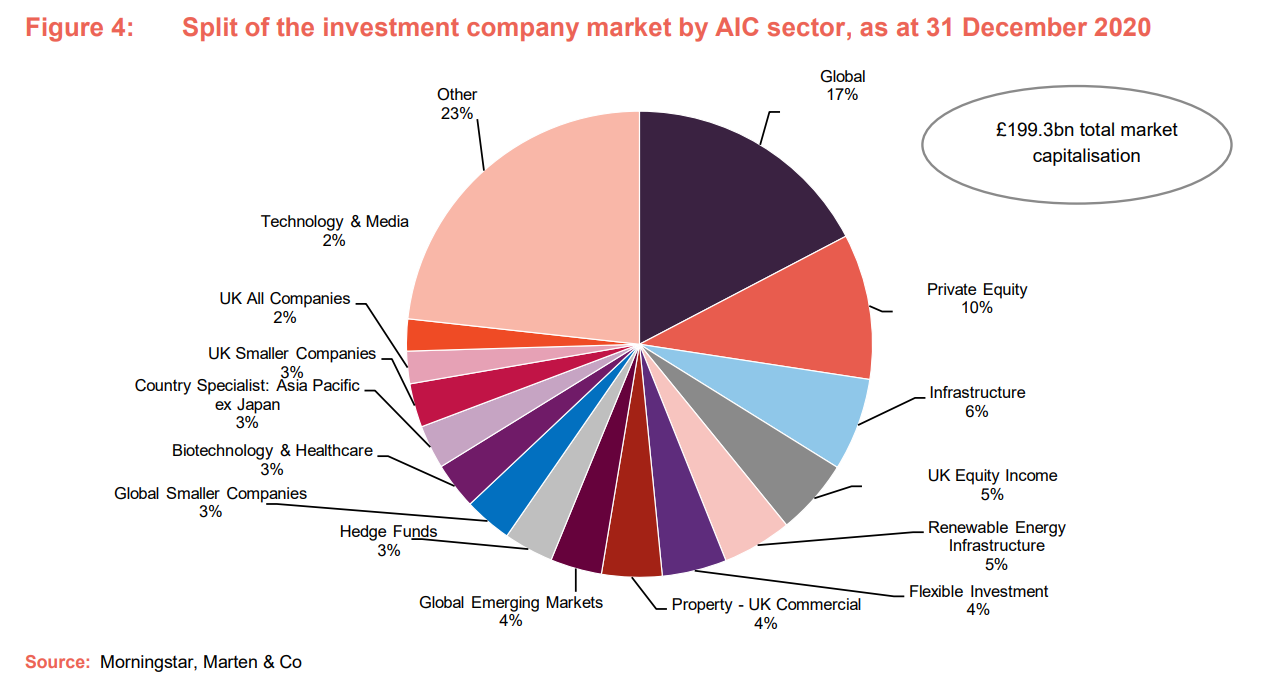

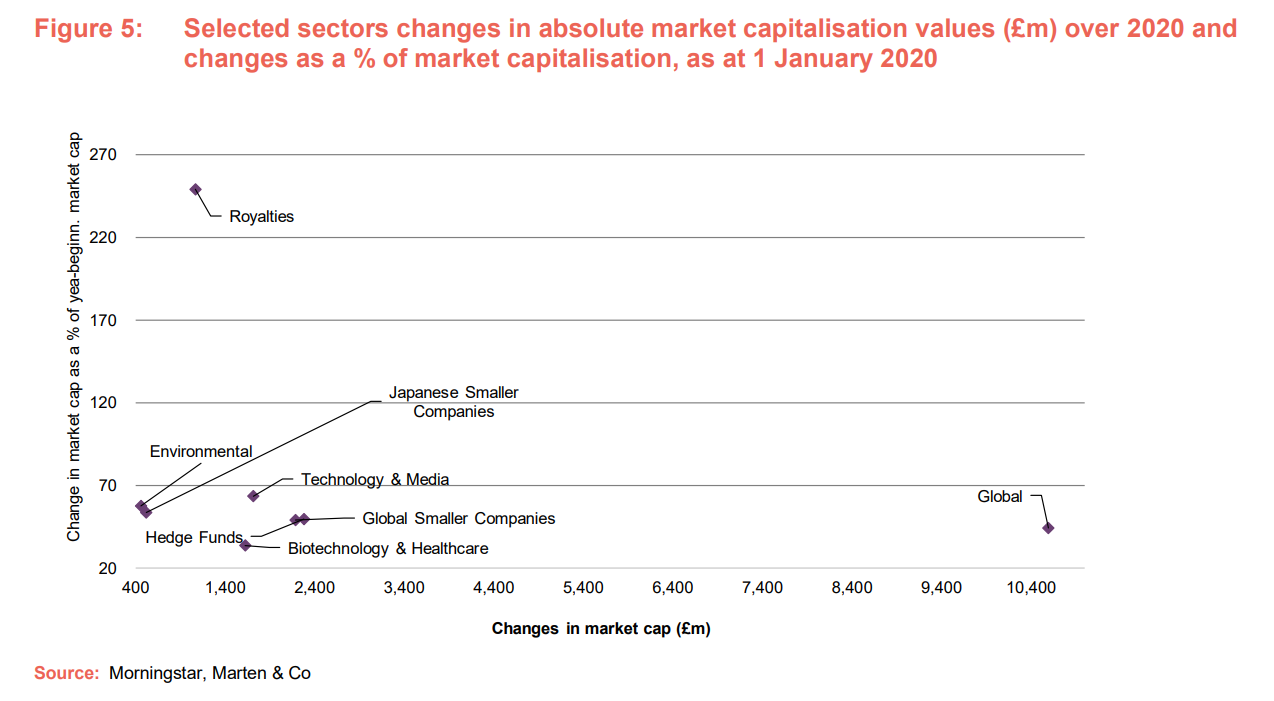

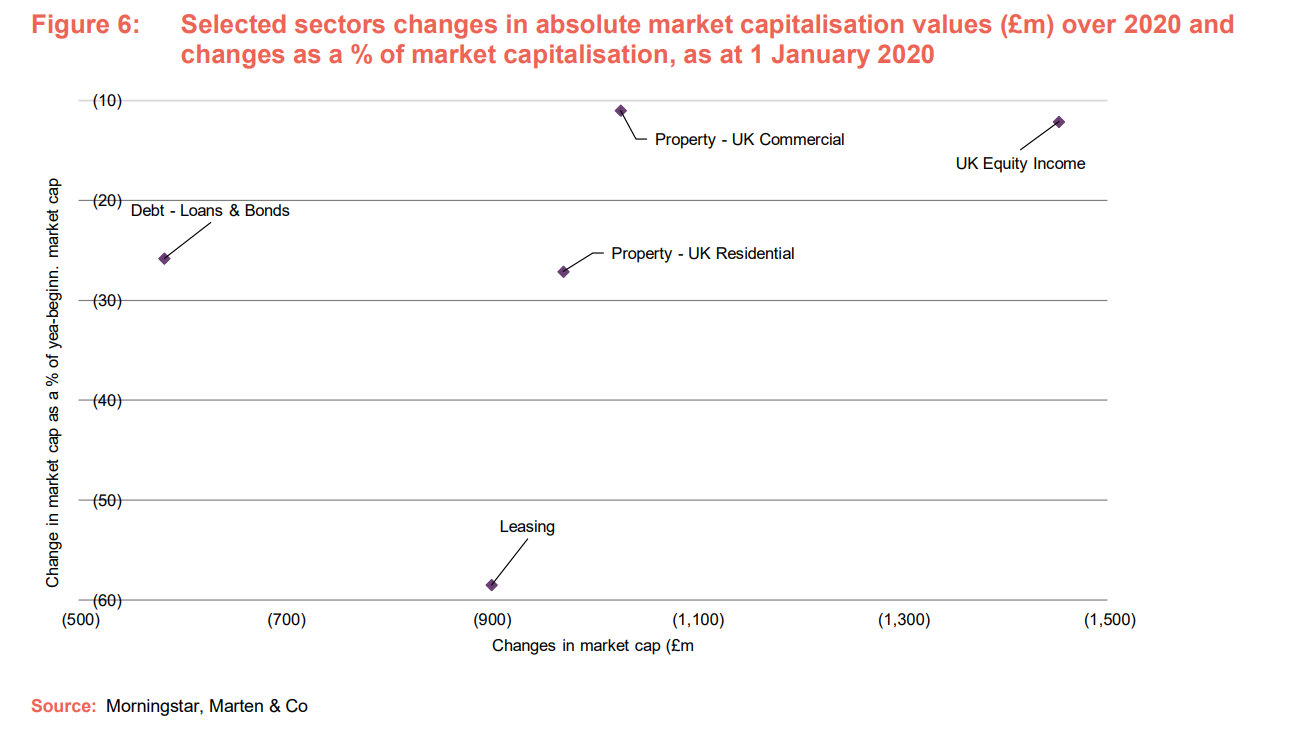

The investment companies sector grew by over £20bn to £199.3bn, in market capitalisation terms, with market movements driving most of this. Figure 4 displays the relative composition of the sector by sector. Figures 5 and 6 plot the absolute and relative changes in sector sizes – the global sector (led by the phenomenal growth of Scottish Mortgage) global smaller companies, hedge funds, technology & media, biotechnology & healthcare, and Asian country specialists led growth in absolute terms.

The royalties sector made the biggest leap, as a percentage of market capitalisation at the start of 2020. Hipgnosis Songs raised over £750m (see Figure 14) and we had the launch of Round Hill Music Royalty. By the same measure, the leasing sector lost nearly 60% of its value, with A380-focused aircraft lessors hit especially hard.

Music royalty funds raised a lot of money over 2020

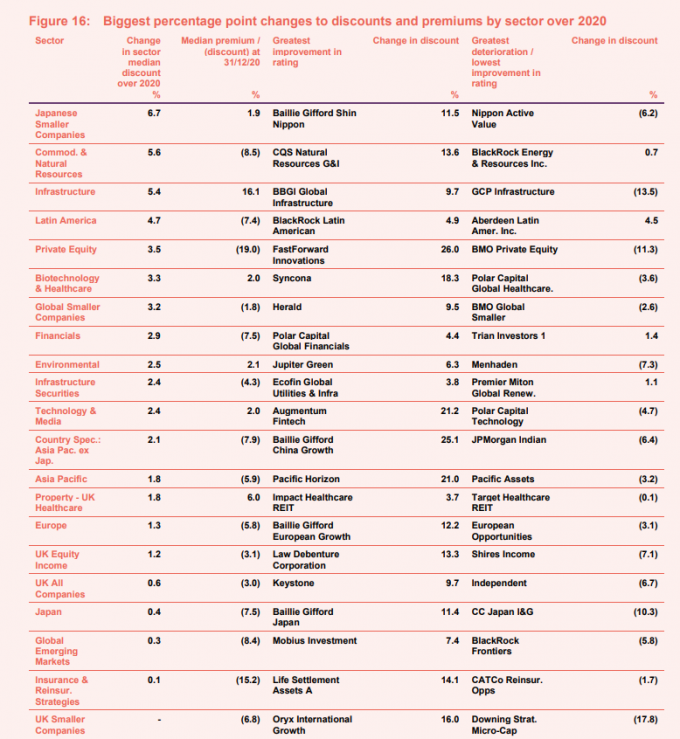

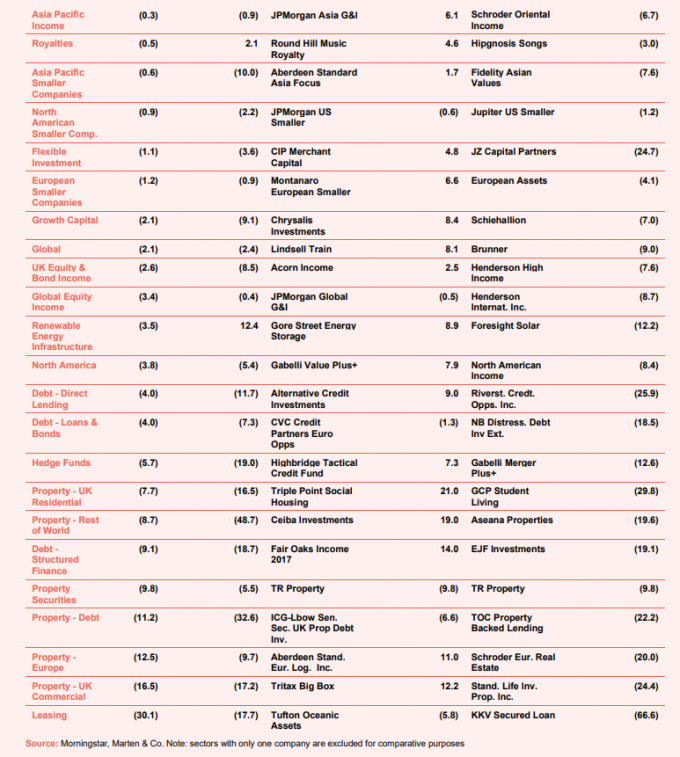

Using the same criterion described on page 5 (in the attached PDF version), the median discount for investment companies as a whole widened from (4.7%) to (5.7%) over 2020. The Japanese smaller companies, commodities, and infrastructure sectors saw the biggest change in terms of becoming ‘more expensive’ relative to NAV, while the leasing, UK commercial property, European property, property debt funds swung the most in terms of becoming ‘cheaper’ relative to NAV.

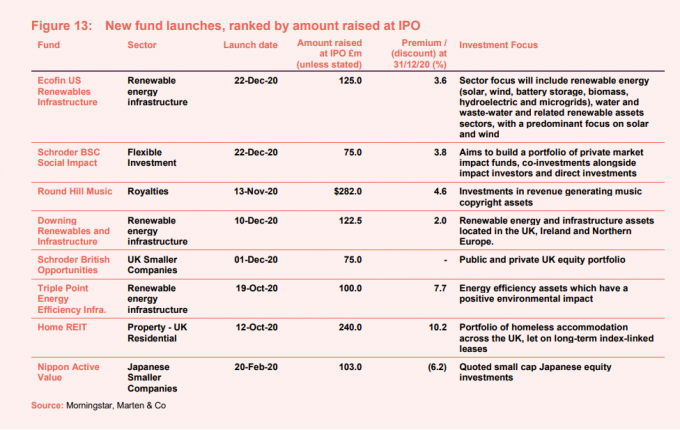

Eight new investment companies came to market over 2020, which was the same amount as 2019. The launches brought in £1.1bn of new money. By comparison, existing funds brought in about £3.8bn in the secondary market, net of the cumulative amount returned to shareholders through share buybacks and tender offers.

Performance

The pandemic set forth perhaps one of the most idiosyncratic years in financial markets history. In the end, the rally that began in late-March in the US, before spreading to Asia, and finally Europe, was sustained to the year-end. As society embraced technology more effectively than almost anyone may have envisaged, economies around the world displayed remarkable fortitude in keeping things ticking along.

South Korea led US dollar MSCI returns

East Asian countries, led by China, reacted decisively, with muscle memory from the 2002 SARS outbreak still fresh. South Korea had the best year based on MSCI USD returns. Denmark had an outstanding year, with its stock market heavily populated by healthcare and clean-energy companies. The collapse in the oil price hit Brazil and Russia hard. The dividend crisis and concerns over Brexit constrained the UK.

Performance by sector and fund

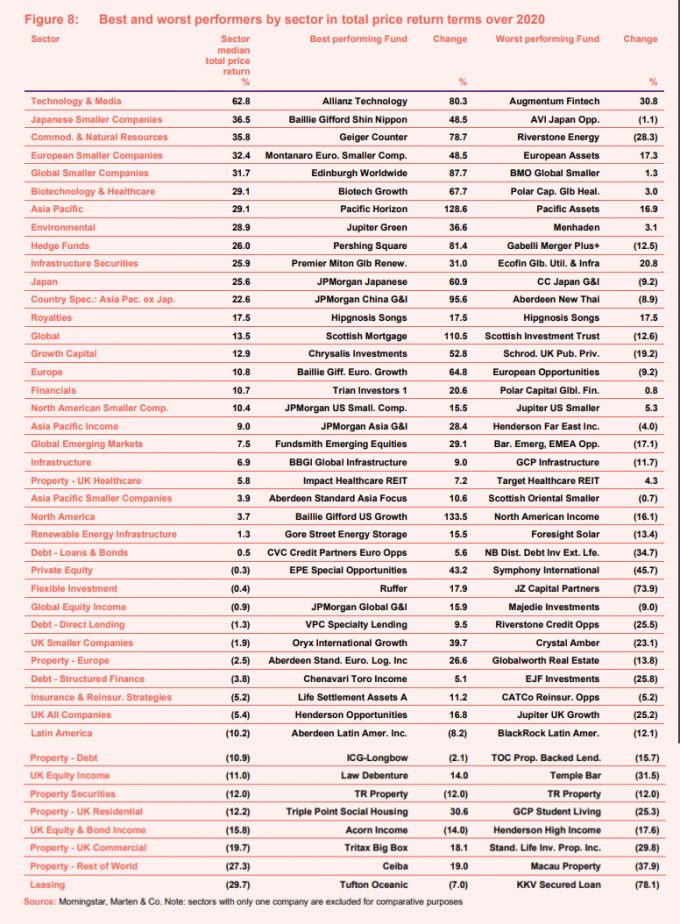

Figure 8 shows how the investment company sectors performed throughout 2020 in median price total return terms, and the best and worst-performing funds in each sector. Out of the 45 sectors shown below, 26 delivered a positive return.

Baillie Gifford had a year to remember, with the three best performing funds of the year (see Figure 9), Baillie Gifford US Growth, Pacific Horizon, and Scottish Mortgage coming under its management.

Allianz Technology was the standout in an outstanding year for technology. Holdings in the likes of Amazon and Tesla delivered considerable value. While Polar Capital Technology had a strong year too, its performance slipped behind that of Allianz Technology largely due to its greater non-US exposure and a built-in lower deviation from the benchmark. Augmentum Fintech’s collection of ‘disruptive technologies’ also proved popular, with adoption of many of this speeding-up as a result of the pandemic.

A fantastic year for tech

Japan strategies had an excellent year, performing especially well in September, where they led global returns. Flows into Japanese strategies were mainly driven by the relatively attractive value on offer, a corporate sector in better balance-sheet health than the vast majority of the developed world, and the belief that new Prime Minister, Yoshihide Suga, will continue Shinzo Abe’s policy agenda. In the small-cap sector, Baillie Gifford Shin Nippon, which has a significant allocation to the industrial’s sector, led performance while AVI Japan Opportunity was laggard. However, the best-performing Japanese fund was the more large-cap focused JPMorgan Japanese.

The commodities sector had a very strong second half to the year. Demand for mining resources returned as China, in particular, returned to normal activity. Oil-exposed funds had to contend with a much tougher backdrop, hitting Riverstone Energy most acutely. Geiger Counter topped the table, beating strong competition from Golden Prospect Precious Metals, which was amongst the best performing funds over much of the year as gold became the safe-haven of choice over the summer months, in particular. Geiger Counter benefitted from a strong in uranium prices in December, which catapulted its shares nearly 60% higher.

Montanaro European Smaller had another good year. The portfolio includes many innovative and promising businesses, some of which are beneficiaries of the shift to home working and investment in healthcare that the pandemic has fostered. Sweden, which performed very well over 2020, is its largest country exposure.

Edinburgh Worldwide, which counts Tesla amongst its largest holdings, has over half its portfolio invested in technology and healthcare companies. The trust had an excellent year, performing well ahead of the median return for the global smaller companies sector. BMO Global Smaller Companies had a poor year by comparison, with the UK weighing down its portfolio.

The Asia Pacific fund, Pacific Horizon, had a phenomenal year as it more than doubled, with a total price return of 128.6%. This represented more than 4.5x the median return of its sector. Pacific Horizon has a strong allocation to mainland China and technology. Its largest holding, SEA Limited, is one of South-East Asia’s leading companies in gaming and online e-commerce. SEA’s share price has increased 10x since it was added to the portfolio in 2017. Pacific Assets was held back by its Indian exposure, which makes up more than one-third of the fund.

It was a whirlwind year for the biotech and healthcare sector, with investors initially pilling in in the race for a successful vaccine. The US election was not considered of significant importance in terms of significantly impacting healthcare policy, once it became clear that Joe Biden and not, perhaps, Bernie Sanders, would be the Democratic candidate. Attention has turned to drug discovery, with Geoff Hsu, manager of Biotech Growth, the sector’s best performer last year, saying we are in a “golden age” of innovation. Polar Capital Global Healthcare was handicapped by an overweight exposure to healthcare equipment companies, which were hindered by the sharp drop in elective procedures, as tackling COVID-19 took precedence.

We have been of the view that China-specific strategies are underrepresented by the investment companies universe. The year began with just two China-only funds – JPMorgan China Growth and Income and Fidelity China Special Situations. They both had excellent years, with JPMorgan China Growth and Income performing particularly well. The pair have since been joined by Baillie Gifford China Growth. Aberdeen New Thai had a poor year, mirroring the Thai economy, which is far more reliant on tourism than its neighbours. The fund was performing poorly before the pandemic too.

Scottish Mortgage 110.5% total market return was 8.2x greater than the median return of the global sector. It has been a long-term investor in Amazon and Tesla and is benefitting from Baillie Gifford’s expertise in the technology and unlisted spaces and its conviction in taking large positions.

Fundsmith Emerging Equities had the best year in global emerging markets, edging out Mobius. Unlike many of the global emerging funds, the Fundsmith fund provides comparatively less exposure to China, Taiwan, and South Korea. India is by far its largest market, so its strong showing despite a patchy year for Indian equities should bode well if the Indian market is to rally this year. Baring Emerging EMEA Opportunities’s (formerly Baring Emerging Europe) mandate was widened to include the Middle East & Africa (MEA). In its former guise, the fund was effectively a bet on Russia, which had a tough 2020. It remains to be seen how popular the linking up of two regions like emerging Europe and MEA, which have little in common, will be.

Baillie Gifford US Growth had an outstanding year returns, performing head and shoulders ahead of its peer group. Moderna, held by the fund since 2018, has been at the forefront of coronavirus vaccine development. It also has sizeable positions in some of the other ‘pandemic winners,’ including Tesla, Amazon, Shopify, and Zoom. Conditions were much tougher for North American Income, which, understandably, has much less exposure to high-growth stocks.

Gore Street Energy Storage performance reiterated the attraction of battery storage, which is set for a critical role in delivering net-zero carbon emissions by 2050, given the more intermittent nature of renewable power generation compared to fossil fuels. Foresight Solar was the renewable sector’s worst performer, falling power price forecasts weighed on the NAVs of many renewable energy funds.

VPC Specialty Lending had the best year out of the direct lenders, managing to maintain its dividend payments. Riverstone Credit Opportunities Income provides financing to the energy sector, where oil prices came under severe strain. Nevertheless, its NAV has held up, the problem is with a widening discount.

Oryx International Growth was the best performing UK smaller companies fund in price terms while Miton UK Microcap delivered the best NAV result. Oryx International Growth takes an activist approach, investing in companies with sound business models that are underperforming their potential. However, fellow activist Crystal Amber struggled. Technology is Miton UK Microcap largest sector allocation, accounting for about 22% of the portfolio.

The logistics area of the property market found a very conducive environment, with the pace of e-commerce adoption seemingly brought forward by several years, as locked down consumers were forced to shop online. Aberdeen Standard European Logistics Income was the best performing Europe-focused property fund while Globalworth Real Estate, with its focus on offices in Central and Eastern Europe, unsurprisingly struggled.

Triple Point Social Housing REIT and Civitas Social Housing had excellent years. Due to the nature of their income – which is ultimately paid through housing benefit from central government – they continued to collect all its rents during the crisis, in contrast to most other REITs. GCP Student Living suffered a material decline in its revenues, with many student tenants returning to their homelands – a substantial number of its units are rented to international students.

Cuban property fund Ceiba‘s shares surged on hopes that sanctions will be eased following the election of Joe Biden and the momentum behind vaccines, which may result in international tourism picking up significantly as the year progresses. Macau Property Opportunities suffered as restrictions were placed on visitors, bringing down gaming revenues and ultimately making it much harder for the fund to sell its remaining property as part of its wind-down.

Tufton Oceanic Assets was the relative ‘winner’ in a chastening year for leasing funds, as the aircraft leasing funds face the prospect of no second-hand value for their planes once leases end. KKV Secured Loan had the worst year, with its shares losing nearly 80% of their value. Its board announced intentions to put forward proposals for a managed wind-down. Towards the end of the year, the fund announced some fairly drastic downward revisions to the value of loans in its portfolio.

Money in and out

2020 delivered eight new issues (listed in Figure 13), raising gross proceeds of about £1.05bn. In addition about £3.8bn of net new money was raised by existing funds in the secondary market, bringing total net inflows to close to £5.0bn. Total net inflows of around £5bn compares with £7.3bn in 2019, which is quite a feat given everything that happened in 2020.

IPOs

Home REIT takes the prize for 2020’s largest new issue. We wrote about it at the time of the IPO. Coupling an attractive yield, derived from government-backed income, and the feel-good factor of providing much-needed new accommodation for homeless people in the UK, we are optimistic that this has the potential to expand in the future.

Home REIT will provide new accommodation for homeless people in the UK

Money in and out of existing funds

Figures 14 and 15 show the approximate value of shares issued or redeemed as at 31 December 2020.

Money coming into existing funds

Hipgnosis Songs had a very busy year expanding its portfolio. Capital raises saw its market capitalisation grow to £1.3bn by the year-end. Music royalties are becoming an increasingly important alternative income source

Hipgnosis has trailblazed the path for music royalties as an asset class, paving the way for the entry of Round Hill Music Royalty. It had been investing in music royalties for over a decade in private markets and it generally carries an older vintage of songs than Hipgnosis.

Supermarket Income REIT grew apace, including a remarkable £139.9m raise in April, not far off the market trough (it was targeting just £75m). The appetite for its shares demonstrated investors’ need for certainty of income. Supermarkets had far fewer problems meeting rent obligations.

Sequoia Economic Infrastructure Income’s early-March £300m raise was £50m above its target.

Worldwide Healthcare raised money through a series of issuances, with its diversified healthcare strategy (by sub-sector and geography) proving popular a time where the sector was very much in favour.

Given the general uncertainty in markets, it was perhaps no surprise that investors sought the relative safety of a fund designed not to lose money as well as to make it – Personal Assets.

The other funds to issue shares worth at least £100m were Gresham House Energy Storage, Aquila European Renewables Income, HICL Infrastructure, Renewables Infrastructure Group, Finsbury Growth & Income, Baillie Gifford US Growth, Monks, Pacific Horizon, Chrysalis Investments, Greencoat Renewables, and BB Healthcare.

Money going out of existing funds

Pershing Square demonstrated its commitment to buying back shares throughout 2020. Pershing Square has been actively attempting to narrow its discount, which stood at (23.0%) at the year-end. Scottish Mortgage shrank as investors took profits following its strong run of performance.

JPMorgan Indian tendered nearly 40% of its issued share capital in early 2020, after failing to outperform its benchmark over three years.

Polar Capital Global Financials offered all its investors a chance to exit the trust at NAV. Over April, shareholders voted to extend its life indefinitely and the trust still has 123m shares in issue. It is now making plans to reissue shares as investors’ confidence in banks has improved.

The NB Global funds are frequent buyers of their stock. The other funds to redeem shares worth at least £100m were Witan, CVC Credit Partners European Opportunities, and Fidelity China Special Situations.

Liquidations, de-listings and trading cancellations

Hipgnosis Songs had a very busy year expanding its portfolio. Capital raises saw its market capitalisation grow to £1.3bn by the year-end. Music royalties are becoming an increasingly important alternative income source

Significant rating changes

Figure 16 shows how discounts and premiums moved over 2020. Most UK-focused sectors closed the year strongly, unsurprisingly given the relative value many see in equities. Equity and specifically growth-focused sectors saw their discounts narrow (premiums widen) while some sectors focused on income performed very well, notably renewables.

We discussed many of the trusts in the table elsewhere in this note. Japanese Smaller Companies moved to a median premium rating of 1.9% by the year-end. Pockets of strength within the commodities and natural resources sector, in precious metals, uranium, and mining, reduced the sectors discount to (8.5%). The infrastructure sector ended the year at a median premium of 16.1%, with its secured flow of revenues, and the ongoing rising tide of ESG investing, continuing to serve as catalysts. In technology, Augmentum Fintech moved from a (8.2%) discount to a 13.0% premium by the year-end and Allianz Technology’s 75.7% NAV return was surpassed by a 80.3% market return.

It was a difficult year for property funds across the board – please refer to the performance section for commentary around the various property sectors. Elsewhere, the renewable sector shed some of its premium rating to end the year at a median premium of 12.4%. Premiums in Greencoat UK Wind and Foresight Solar shed the most. Concerns over long-term power prices are likely to have weighed on sentiment, though the sector should benefit from considerable government support over the coming years, as part of a ‘green recovery’ and legally binding 2050 decarbonisation targets.

Major news and views from 2020

Portfolio developments

- Pershing Square booked astonishing profits on hedges it made between late February and early March

- Greencoat Renewables made its first investment into continental Europe with a 51.9MW France investment

- DP Aircraft I said that Norwegian had missed a lease payment

- JZ Capital Partners updated on its real estate write-downs

- Amedeo Air Four Plus completed the sale of two A380s to Etihad for a net £130.9m

- JLEN set out its plans for the future

- SQN Asset Finance discussed its future plans

- Polar Capital Global Financials said in May that it would maintain an equivalent level dividend this year

- US Solar said there had been no material impact on its construction timeline or operating cashflows

- Greencoat UK Wind struck a £320m subsidy-free deal

- RTW Venture’s iTeos holding IPOed at a 1.8x multiple to the fund’s investment

- Gore Street Energy Storage said it expected to benefit from a legislation change that could see grid projects triple

- Bluefield Solar bought a portfolio of 15 ground-mounted solar PV plants for an initial £106.6m

- European Opportunities discussed Wirecard

- Aberdeen Diversified Income and Growth said it would increase its focus on private market investments

- Nippon Active Value targeted Sakai Ovex

Corporate news

- Pollen Street Secured Lending was the subject of a £675m takeover bid and fell out with its manager

- India Capital Growth received the backing it needed for continuation

- Polar Capital Global Financial’s life was extended indefinitely following a shareholder vote

- JZ Capital said it would not be making new investments

- It was announced that Perpetual Income and Growth and Murray Income would merge

- In a surprise move, Jupiter UK Growth is to liquidate the fund after deciding it was unlikely to succeed in growing the fund

- Witan Pacific moved to Baillie Gifford, where it became become Baillie Gifford China Growth

- Gabelli Value Plus+ failed its continuation vote

- Aberdeen Frontier Markets was wound up after failing to beat its benchmark over the two years to 30 June 2020

- Secured Income published wind-down proposals

- JPMorgan Brazil lost its continuation vote

- Greencoat UK Wind launched a major fundraise, subsequently raising £400m

- CC Japan said it was planning a subscription share issue

- Riverstone Energy has two years to prove itself

- Golden Prospect’s subscription shares were exercised

Managers and fees

- Strategic Equity Capital got a new lead manager

- Temple Bar appointed RWC Asset Management, while also confirming its decision to sticks with a value style

- Troy Asset Management won the mandate for Securities Trust of Scotland

- Aberdeen New Thai’s board got tough after poor year

- Alliance Trust announced the appointment of Lomas Capital Management

- Jupiter US Smallers appointed Brown Advisory

- Boussard & Gavaudan’s manager opposed a tender

Property news

- The impact of COVID on the West End was laid bare in

Shaftesbury’s results - Primary Health Properties reported a 7.1% jump in earnings

- Schroder REIT reinstated its dividend at 50% of the previous level

- Phoenix Spree bucked the trend as Berlin showed resilience

- Civitas Social Housing had a good year, collecting a close to all its rent

- Residential Secure Income agreed a new £300m debt facility

- Intu, the biggest shopping centre owner in the UK, went into administration

Selection of QuotedData views

- Is a European logistics powerhouse on the cards? –

11 December - UK clear-out heralds better times – 11 December

- Good governance might start with you – 4 December

- What next for Debenhams, Arcadia landlords? – 4 December

- Positive social impact – 27 November

- The valuation game – 20 November

- Looking after the environment – 20 November

- Latin America – the only way is up? – 6 November

Outlook for 2021

Rather than us pontificating on how events may unfold in 2021, here are a few recent comments from managers and directors drawn from our latest economic and political summary that you may find interesting.

Our January economic and political roundup has much more detail and many more comments on sectors including Europe, North America, China, emerging markets, biotech

and healthcare sector, and technology

On the global economy

Peter Ewins, manager of BMO Global Smaller Companies, noted that: “News of highly encouraging results from the trials of several potential COVID-19 vaccines in November have led to a dramatic further rally in global equities. Most of the best-performing stocks since this news have been those which did badly as the pandemic struck, while companies which had been more resilient in the first half of the financial year have mainly lagged. This has been a rational response by the markets to the potentially transformed outlook for 2021. However, the speed with which vaccines can be rolled out safely to the general population will be key to determining if the recent changes in sector trends are to be maintained and the extent to which corporate earnings can be re-built. As mentioned above, the conclusion of the Brexit discussions will be important for the UK equity market especially at the smaller company end of the spectrum. This will also have wider ramifications, especially for European stocks and sterling in the foreign exchange markets. We have made some adjustments to the portfolio to increase exposure to companies we see as offering greater exposure to recovery in a post-pandemic world, while trimming some of those where valuations look more stretched after the market run-up. The scale of economic and market dislocation this year means that there are still opportunities even after the recovery so far, although at the macro-level many countries will take some time to get back to pre-COVID levels of activity.

We need to be conscious of the lasting damage done to certain sectors and companies in these areas. Frighteningly large fiscal deficits are not today’s central problem but will need to be addressed in time.”

James Will, chairman of Scottish, said the following: “The course of the pandemic remains a matter of serious concern to markets and recent news about vaccines has been well received. Clearly, there will be challenges to come, not least managing the current wave of COVID, but we believe the reaction to the vaccine newsflow demonstrates the potential for recovery in beaten down and overlooked areas should the good news be sustained.

The drama around the US presidential election was emblematic of Donald Trump’s tenure, but apparent President-elect Joe Biden is likely to bring a more diplomatic approach to the role. That said, President Trump clearly galvanised a substantial portion of the population and his better than anticipated showing perhaps suggests that the populist tendencies of recent years could be a durable trend.

While it is certainly premature to look beyond the impact of the virus, eventually attention will turn to how we deal with the long-term effects of the ‘whatever it takes’

fiscal and monetary response. While these measures were undoubtedly necessary to avoid more lasting damage to jobs and businesses, we have now entered a new era in economic policymaking. It has become obvious, especially to those who wish to control the levers of power, that governments can borrow without regard to the tax-base as interest rates remain very low. Borrowing and spending money is popular.

Central banks have directly or indirectly communicated a greater tolerance for inflation, which may prove an unstoppable development once it becomes apparent. This, combined with the eventual prospect of higher rates of interest, may favour our investment style over others.

The divergence of valuations within markets has reached new extremes, a position that we believe is unsustainable and likely to reverse. This favours a contrarian approach which seeks out mispriced investments that have been overlooked. We believe that the Company is well placed for the future.”

On the UK

The manager of Schroder UK Mid Cap noted the following: “Looking back over the last year, the only thing we can say with certainty is “well, nobody expected that.” This has been a year of significant highs and lows, of human tragedy, volatility, of economics battling life sciences and of emotions running high. At the time of writing, two announcements on stage 3 trials of COVID-19 vaccines have driven a recovery in many of the shares sold off aggressively at the start of the pandemic. The US is preparing to welcome a new president, and Brexit deliberations are moving at an accelerated pace, as is news flow on incoming UK M&A. We are not trying to second guess any of this: instead, we are focusing on making sure that we hold shares in companies which are either disruptors, changing the status quo within the marketplace, or established companies which can grow sustainably as they reinvent themselves in response to the disruption, companies which we refer to as long-term growth opportunity stocks. Neither do we target a specific level of gearing: future levels of gearing will be a function of the opportunities we see in the market.

In the first few months of the pandemic, we were asked what new trends were emerging and if they would change our investment approach. This led us to examine our core long-term growth opportunity stocks, and whether we believed that the opportunities we saw previously would persist in a post-COVID-19 world. Trends which we observed early on do seem to be becoming established. The shift from store-based to online retail and more frequent working from home have accelerated and been reflected in strong trading. Though many of these stocks have been coronavirus beneficiaries, we see them as able to continue to deliver sustainable growth post-pandemic.

News that the UK economy grew by 15.5% in Q3 has been dismissed by some commentators as merely the product of pent-up demand, but salaries are also, now, higher than they were in Q4 2019, which shows that fiscal transfers are supporting income (albeit at a cost). This in turn should support a strong recovery once the current lockdown eases. Though we anticipate a wobbly V-shaped recovery in terms of a rebound in GDP, we recognise that companies will continue to face headwinds caused by this most recent disruptive event.

We have said previously that economic turmoil could trigger progress, thinking of the post-World War II era, for example. Much has been written about the frustratingly low growth in UK plc’s productivity. The one good thing to come out of this pandemic is that it has forced ‘old economy’ stocks to cast aside entrenched behaviours, achieving five years of change in six months. That can only be a good thing in the long term for the profitability of companies and the health of the economy. It is too early to tell, but it might also be the case that behaviour around distribution of earnings as dividends to shareholders might moderate, long term, with management teams seeking to increase investment to grow companies in preference to distribution.”

George Ensor, manager of River and Mercantile UK Micro Cap, said that “the opportunity set remains as rich as ever; the combination of our approach, the lack of sell-side coverage and the inability for larger funds to access this part of the market remains supportive for investing in great undervalued businesses. UK equities are a consensus underweight for global asset allocators and, whilst narrower than a year ago, there remains an additional discount on smaller-cap equities within the UK.”

Nick Train, director of the manager of Finsbury Growth & Income, noted that “the pros are always too cautious about the stock market. And this caution creates opportunities for those who take a more constructive view. Now, I grant you, this third idea has proven harder to justify in 2020 – at least from the perspective of an investor in the moribund UK stock market. Perhaps it has been right to be cautious about the short-term outlook for the FTSE All-Share Index. Nonetheless, to demonstrate what we mean, consider that as I write this – with the virus still rampaging – the S&P 500 Index in the US is up 14% in 2020 and NASDAQ up 40%. Those gains may seem inevitable in hindsight, but few professionals would have predicted them, we submit, if apprised of what was actually about to befall the world. No – we still act on the assumption that it is a winning investment strategy to take a steadfastly optimistic view about the prospects for equity markets – including that of the UK. This means that we hold as little cash as possible and don’t try to time the market.”

On China

Shumin Huang, Rebecca Jiang, and Howard Wang, managers of JPMorgan China Growth and Income, believe that “China’s importance in the world continues to grow and its economy is likely to continue growing faster than its global peers. The economic transformation and evolving role of the country as a global economic superpower is well underway with recent challenges unlikely to derail progress in any material manner.

The Chinese government is continuing to promote coordinated pro-growth policies, while deepening reform measures in order to deal with the cyclical (domestic) headwinds and structural (external) challenges. The magnitude of such supportive policies will be dependent on how the world ultimately deals with the pandemic and the eventual outcome of the ongoing China-U.S. trade negotiations. The latter seemed to have been superseded in importance by the clearest indications yet that the US is seeking to limit China’s access to the latest cutting edge technologies, so as to slow the country’s ability to catch, or even surpass, US dominance.

China’s importance in the world continues to grow and its economy is likely to continue growing faster than its global peers. The economic transformation and evolving role of the country as a global economic superpower is well underway with recent challenges unlikely to derail progress in any material manner. Moreover, given the recent fiscal and monetary measures (such as VAT reductions, waiving toll fees, liquidity injections and interest rate cuts) we believe that the market outlook remains broadly positive.

Globally, the continued spread of COVID-19 means that the outlook is likely to remain challenging for the immediate future. Yet we take some comfort from the Chinese government’s strong containment measures and proactive economic policies which have clearly defined the country’s bounce-back from the coronavirus shock: corporate revenues, supply chains and investment markets have all recovered decisively.

Looking ahead, we expect the Chinese government’s countercyclical policies to continue to be measured and appropriate, both in terms of size and scope, targeting the real economy without significantly increasing leverage risks for the financial system. This points to moderately slowing but likely higher-quality macroeconomic growth. Valuation wise, our internal data suggests that we are around long-term average levels. We acknowledge that volatility and external shocks (such as trade and politics) may hinder a broader-based cyclical recovery in the short-term but we are reassured that interest in the domestic market from foreign investors has remained strong, on the back of the opening up of the onshore equity markets. Given this macro backdrop, we remain broadly optimistic on the outlook for China equities.”

Dave Nicholls, manager of Fidelity China Special Situations, notes that “while there are variances between regions and sectors, overall, the economy continues to recover. Successful control of the COVID-19 virus has clearly been a factor supporting the China recovery. Small localised outbreaks within the China region were handled swiftly and have not dented the improving overall economic momentum.

This is reflected in China’s Purchasing Manager’s Index (PMI) which has recovered much sooner than other Asian countries.

The third-quarter GDP growth figure of 4.9% was supported by stronger services and external demand. Key laggards in the service sector – travel and leisure – are now gaining momentum after restrictions were loosened in mid-July 2020. Government stimulus has clearly been a factor supporting the recovery, but on the whole, has been more restrained and targeted than measures seen in most Western economies. Among supportive measures, the People’s Bank of China (PBoC) announced cuts in its re-lending and re-discount facilities to reduce funding costs for smaller firms and rural sectors. Separately, both the end of July 2020 Politburo economic meeting and the PBoC’s second-quarter Monetary Policy Implementation Report confirmed that the monetary policy has turned towards a more neutral stance since May 2020, although the rollover of fiscal stimulus will continue. China remains on track to be the only major economy to grow in 2020.

We continue to see an acceleration in capital market reforms in China; from the loosening of short-selling restrictions, the lowering of foreign investment restrictions and the implementation of a registration-based IPO mechanism. The registration-based IPO mechanism was launched last July on STAR Board and is now being employed on ChiNext.

In these markets, listing requirements are more flexible, such as alternative criteria on market cap, profitability, and allowing variable interest entity (VIE) structured companies to list. These were restricted under previous rules, so given this flexibility we could expect more technology/new economy companies listed on the A-share market. We have already seen more IPOs of A-share and Red chip companies this year, and it is probable that we will see more to come given the US issues and the more flexible listing requirements. For example, the Hong Kong Stock Exchange raised a total of HK$ 87.3bn in the first half of 2020 from 59 new listings, marking a total increase of 22% in total funds raised compared with the same period last year*, and ensuring it maintained the top position in equity raising globally. Recent changes such as the removal of the QFII quota, the widening of the investment scope and the integration of the QFII and RMB QFII schemes will likely further boost inflows. The delay in Ant Group’s IPO could be viewed as a setback, but we believe the momentum is clearly in the direction of deregulation and the opening up of markets.”

Investment company notes published in 2020

- Aberdeen Standard European Logistics Income – Expansion on the radar

- Ecofin Global Utilities and Infrastructure Trust – A wealth of opportunities

- India Capital Growth – A win-win scenario

- Polar Capital Technology – More to go for

- BlackRock Throgmorton – Infectious enthusiasm

- JP Morgan Japanese Investment Trust – Strength to strength

- Henderson High Income Trust – Robust high yield

- Lar España Real Estate – Built to last

- Alliance Trust – A trust for all seasons

- Tritax EuroBox – Boxing clever

- Downing Renewables and Infrastructure Trust – Targeting attractive and sustainable income returns

- Jupiter Emerging & Frontier Income – Underappreciated emerging and frontier income access

- International Biotechnology Trust – Healthy returns

- Herald Investment Trust – Hot chips

- Civitas Social Housing – Solid foundations for future growth

- Polar Capital Global Financials Trust – Too much pessimism?

- Seneca Global Income & Growth Trust – Knit one, purl one

- Montanaro European Smaller Companies Trust – Impressive returns in difficult market

- Standard Life Investments Property Income Trust – Building for a new normal

- Temple Bar Investment Trust – Keeping faith

- Aberdeen Emerging Markets Investment Company – Peer group leading China exposure

- Home REIT – Tackling Homelessness – IPO

- JPMorgan Japanese Investment Trust – Number one for a good reason

- Premier Global Infrastructure Trust – Renewed focus

- Aberdeen New Dawn – COVID positive

- Geiger Counter – Hot stuff

- Seneca Global Income & Growth – On the rebound

- Shires Income – Preference shares paying dividends

- Henderson Diversified Income Trust – Favourable style and structure

- Standard Life Private Equity Trust – Share price out of sync?

- Grit Real Estate Income Group – Africa, substantially de-risked

- CQS New City High Yield – Sitting pretty

- Ecofin Global Utilities and Infrastructure Trust – Resilient income

- CQS Natural Resources Growth and Income – Recovery on-hold, hold on

- The North American Income Trust – Purest access to US equity income

- BlackRock Throgmorton Trust – Separating the wheat from the chaff

- Aberdeen Standard European Logistics Income – Resilient to covid-19

- GCP Infrastructure – Rebased dividend

- India Capital Growth – Needs more time

- Vietnam Holding Limited – Early mover advantage

- Henderson High Income Trust – Able to commit to the dividend

- JLEN Environmental Assets – Reliable source of income

- Polar Capital Technology – Confidence building

- Seneca Global Income and Growth – Triple whammy but standing by the dividend

- Strategic Equity Capital – Focused on fundamentals

- Civitas Social Housing – Proved its mettle

- International Biotechnology Trust – Trust in biotech

- Herald Investment Trust – Change is a coming

- CG Asset Management – More than a port in a storm

- Premier Global Infrastructure Trust – Don’t stop me now

- Montanaro UK Smaller Companies – Reputation restored

- Aberdeen Emerging Markets – Focused on returns

- Polar Capital Global Financials Trust – New lease of life

- Standard Life Investments Property Income Trust – Adding value in cautious times

- Aberdeen New Dawn – Illuminating value

- Shires Income – Building on a great 2019

- GCP Infrastructure – Stable income, uncertain times

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.